OBBBA may cut residential solar adoption in the US by 46% through 2030 compared to business-as-usual forecasts

Elimination of Section 25D ITC will make rooftop solar less affordable and slow near-term installations

Long-term total addressable market remains strong, with 70 million expected to add solar by 2050

Wood Mackenzie’s latest report warns that the One Big Beautiful Bill Act (OBBBA) could slash US residential solar capacity by up to 46% through 2030 in the low-case scenario vis-à-vis its business-as-usual (BAU) base case from Q2. However, the report also highlights the segment’s strong long-term potential, projecting a total addressable market of nearly 1,500 GW by 2050, with over 70 million single-family homes expected to add solar in the next 25 years.

According to Wood Mackenzie’s Near-term challenges but long-term potential: evaluating the US residential solar addressable market report, the elimination of the Section 25D investment tax credit (ITC) by the end of 2025 will severely impact affordability and adoption of residential solar in the country in the near future.

New rules do allow third-party owned (TPO) systems to qualify for ITC and bonus adders after 2025 under Section 48, but the projects will be subjected to foreign entity of concern (FEOC) restrictions. Moreover, US President Donald Trump’s executive order of July 7, 2025, is likely to lead to tougher enforcement of the repeal of solar and wind tax credits (see Trump Signs Executive Order To End Green Energy Subsidies). The report writers caution that this lack of demand in the near future will wipe out many companies from the business.

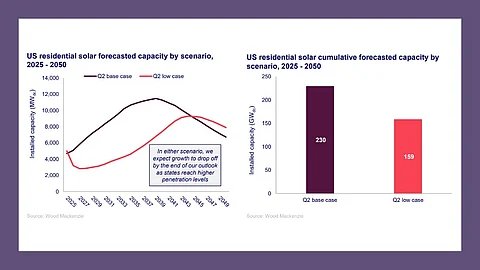

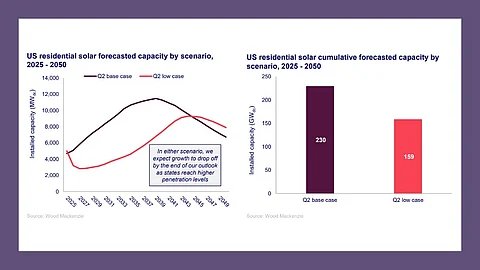

As of the end of 2024, only 7.5% of suitable homes in the US had rooftop solar, as per a new Wood Mackenzie report. Without major policy changes, analysts expected the market to grow at an average annual rate of 9% each year over the next 5 years and reach 13% adoption by 2030 under the base case scenario that did not factor in the OBBBA.

In its low-case scenario where solar no longer gets tax credits after 2025 and other negative trends continue, the report expects solar adoption to fall sharply – by 46% compared to the base case – posing serious challenges for the industry.

All is not lost, though, as per Wood Mackenzie’s Principal Analyst, US Distributed Solar, Zoe Gaston, who assures that the market will eventually adapt to the changes and companies will diversify and cut costs to stay in business. Increasing retail rates will continue to make the residential solar value proposition more compelling.

According to Gaston, the residential solar market will return to growth by 2028 and add more than 150 GW DC capacity by 2050, even in the report’s low case scenario, thanks to over 70 million single-family owner-occupied US homes that can add solar over the next 25 years. This number does not include unsuitable properties and homes with solar panels already installed.

“However, a lot can change in 25 years, including technological and product advancements, business model evolution, and cost declines that can accelerate residential solar growth,” added Gaston. “We expect a more positive outcome than our low-case scenario.”

The report can be purchased from Wood Mackenzie’s website for $3,000.

Earlier, Wood Mackenzie had slashed its 10-year solar forecast for the US market by 17% owing to the OBBBA (see Wood Mackenzie Cuts 10-Year US Solar Outlook By 17%).

TaiyangNews is co-organizing the 2025 Solar Made in USA summit in collaboration with RE+ and EUPD Research. To be held on September 8, 2025, in Las Vegas, US, during the RE+ 2025 event, it will feature leading names from the world of solar to discuss the future of US solar and storage manufacturing, and strategies for the players going forward under the regulatory hurdles created by the OBBBA. Registrations are open and can be done here.