Solar power purchase agreement (PPA) prices went up by 3% sequentially in North America during Q4/2023, driven by developers facing economic uncertainty, says LevelTen Energy in its latest round-up of the market.

The renewable energy transaction platform covers PPA price data at 25th percentile, basing its report on prices that developers are offering for PPA contracts and not transacted prices.

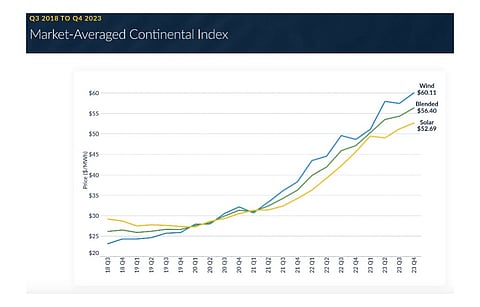

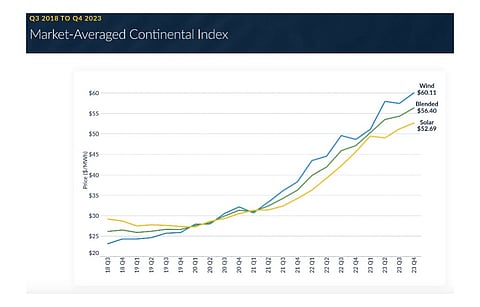

In its report Q4 2023 PPA Price Index North America for the North American market, LevelTen says solar PPA prices went up 3% sequentially overall on a national level to $52.69/MWh. In the previous quarter, it was reported as $51.23/MWh (see Rising Costs Impacting RE Developers In North America).

However, the trend varied across various Independent System Operators (ISO) during the reporting quarter. In the California Independent System Operator (CAISO) market of the US, P25 prices went up 15%, but came down by 3% in Electric Reliability Council of Texas (ERCOT) and 2% in Southwest Power Pool (SPP).

The report writers attribute the decrease on an easing solar supply chain and lower PV module prices. On the other hand, the increase was due to high interest rates placing substantial pressure on project returns of developers who must secure financing.

"The push-pull dynamics of solar PPA prices persist," explains LevelTen Analyst, Energy Modeling, Sam Mumford, "We're seeing improvement in the challenges of a few years ago like the solar supply chain and PV module prices. However, the impact of high interest rates is now impacting project returns, offsetting the impact of those improvements and making it challenging for developers to reduce solar PPA prices."

For wind energy, P25 prices in North America rose by 5% as developers incorporate expectations around existing and expected uncertainties into their PPA pricing equations. Like the solar PV domain, the wind energy segment also suffered from high interest rates and growing risk of curtailments leading to high prices, explains LevelTen.

The future, however, is bright for renewable energy in North America, thanks to the growing demand for clean energy and the corporate appetite for the same. The report writers caution that higher interest rates are a reality now and the industry will need to adapt to it as banks implement stricter financing requirements. This will also require a deeper collaboration between PPA buyers and sellers.

The entire report can be purchased from LevelTen's website.

In comparison, P25 prices for the European solar market declined sequentially during Q4/2023 (see Solar Module Oversupply Brings Down European PPA Prices).