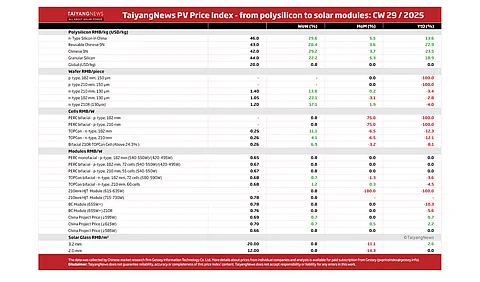

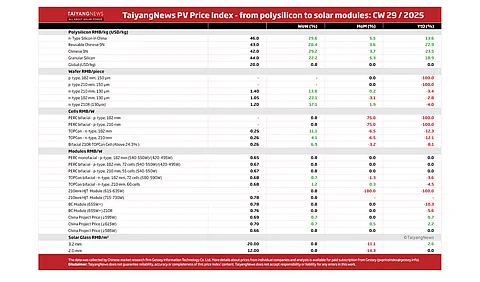

The TaiyangNews PV Price Index pivoted sharply to the positive in Calendar Week 29, with most upstream products seeing double-digit increases, apparently as a result of the MIIT calling for curbing ‘disorderly and low-price competition’.

The polysilicon category recorded the highest price increases this week, with all listed Chinese silicon types experiencing price increases ranging from 22.2% (granular silicon) to 29.6% (Chinese n-type silicon).

The wafer category also saw double-digit price increases, ranging from 13.8% to 22.1%.

TOPCon n-type cells posted week-on-week gains of 4.1% (210 mm) to 11.1% (182 mm). P-type cells remain unlisted for the third consecutive week, indicating a continued phase-out.

In the module segment, TOPCon bifacial products rose slightly, by 0.7% (182 mm) and 1.2% (210 mm). China Project Price categories (≥595W and ≥615W) also increased by 0.7%.

Solar glass prices remained flat in CW29.

With MIIT’s call for an end to low-price competition earlier this month, there seem to be some first effects upstream. With the price increases in Calendar Week 29, the polysilicon category has moved into positive territory YtD, while n-type wafers, cells, and modules are staging a turnaround. On the other hand, the gradual phase-out of p-type products continues. It remains to be seen how sustainable this price uptick is as global demand in H2 will be much lower than in the first six months following the recent changes in solar market design in China.

The data refers to average product prices in China. The data was collected by Chinese market research firm Gessey PV Consulting.

Disclaimer: TaiyangNews does not guarantee reliability, accuracy or completeness of this price index’ content. TaiyangNews does not accept responsibility or liability for any errors in this work.