US based climate insurance company kWh Analytics counts extreme weather as a significant risk for the profitability and reliability of solar assets in the US, and recommends resilient design characteristics to withstand projects being built in harsher weather environments.

It lists 12 industry challenges in its 5th annual 2023 Solar Risk Assessment report to which NREL, EnergySage, RETC, Envision Digital, BloombergNEF, Clean Power Research, Raptor Maps, PVEL, ICF and Wood Mackenzie have contributed. The report is intended to work as a guide to provide objective and data-driven evaluation of solar risks.

As per the report, hail stow plays a vital role in ensuring the longevity and lasting functionality of solar modules, hence a proactive hail stow program can reduce property insurance premiums. It is becoming more important since several facilities are being built in central US that's more prone to hail.

Analysts claim in the report that modules made using tempered glass are approximately 2 times more resilient to hail impacts as those with heat-strengthened glass. Similarly, glass-glass modules are more than twice as likely to break compared to glass-backsheet modules.

Assessing financial modeling risks, while also factoring in the impact of Inflation Reduction Act (IRA), the report writers point out that underestimation of modeling uncertainty means PV projects experience P99 scenarios once every 20 years. They point out the lack of accounting for uncertainty in equipment performance when qualifying the likelihood of downside scenarios as the main driver for this discrepancy.

For the uninitiated, P99 refers to an estimate according to which the level of annual generation forecast is expected to be exceeded with 99% probability.

System costs are likely to decline in 2023 with a 3% drop expected for residential and commercial segments. Utility scale projects, on the other hand, will find 6% annual increase in these costs for an average 100 MW DC system since these face 1-year lag in procurement, having been bought in 2022 and used for projects coming online in 2023.

Inflation is another worry since these are pushing up labor costs that contribute to the overall system cost. "The prevailing wage and apprenticeship requirements required to qualify for tax credits may further drive-up labor costs," it cautions.

BloombergNEF Research Analyst Pol Lezcano believes once the 'tariff dust' settled, module prices in the US could drop down to below $0.30/W by 2025, compared to $0.38/W and $0.44/W in 2023 and 2024. Even as the country will see module supply being met from the US and India plants, the US fabs will still struggle to be cost-effective with best-in-class plants in the Southeast Asia, despite the subsidies.

Lezcano predicts over 50 GW of annual cell production capacity to be available tariff-free in Southeast Asia by 2024-end, which will be enough to meet its projected US solar demand of 42 GW to 52 GW annually between 2025 and 2030.

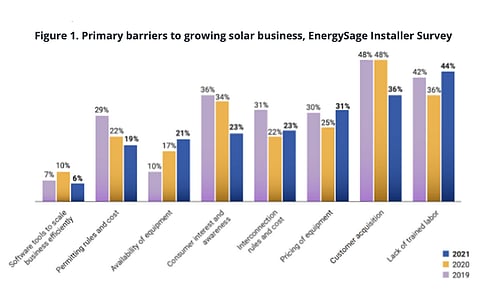

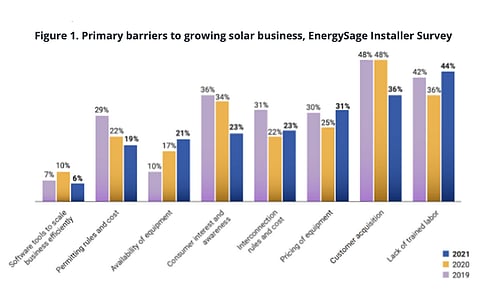

The report also touches upon operational risks for solar assets calling lack of trained labor as the 'biggest barrier' to growth for solar companies. It also says equipment-driven underperformance is leading to significant losses as widespread solar underproduction continues.

kWh CEO Jason Kamisky says mitigation of the risks covered in the report will be critical to solar industry achieving sustainable growth. It would, however, require industry leaders to continue working together as the world faces new environmental, technological, legislative, and economic challenges.

Complete report is available for free download on kWh's website.

.png?w=50&fm=png)