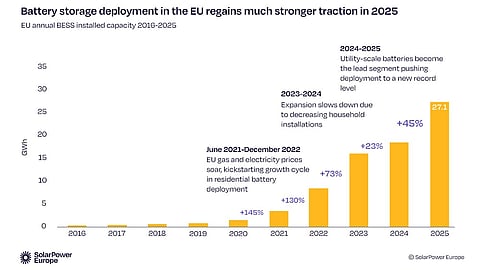

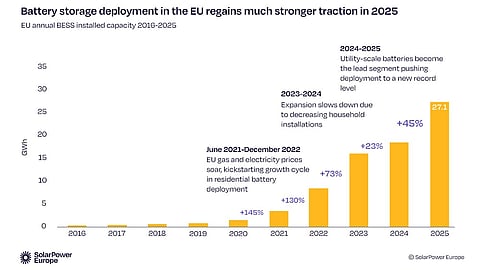

EU battery storage installations rose 45% YoY in 2025, bringing cumulative capacity to 77.3 GWh, according to SolarPower Europe’s new report

Utility-scale batteries accounted for 55% of new installations in 2025, making them the main driver of growth

Residential battery installations declined by 6% due to lower electricity prices and the phase-out of support schemes

The top 5 markets – Germany, Italy, Bulgaria, the Netherlands, and Spain – accounted for 63% of new capacity, down from nearly 80% a year earlier

In 2025, the EU had 252 GWh of nominal battery cell manufacturing capacity, largely serving the EV sector

Battery storage installations in the European Union (EU) continued to grow strongly in 2025, rising 45% year-over-year (YoY) to 27.1 GWh, according to SolarPower Europe (SPE). The industry body said this was the 12th consecutive year of growth for battery storage deployment in the region.

Since 2021, this segment has grown 10-fold, rising from 7.8 GWh to 77.3 GWh on a cumulative basis. While there was a 145% growth between June 2021 and December 2022 due to higher electricity prices prompting increased interest in residential battery deployment, it tapered to 23% between 2023 and 2024, which SPE blames on a decrease in residential installations.

The residential battery space suffered another year of decline, totaling 9.8 GWh and representing 6% less capacity installed due to lower electricity prices and the phase-out of emergency support schemes, notes SPE in its report EU Battery Storage Market Review 2025.

Lead Author of the report and SPE Market Analyst, Antonio Arruebo, stressed the need for clearer policy support in distributed batteries for businesses and households.

While solar energy is integral to the decarbonization of the EU electricity market, storage has become essential to keep the bloc’s renewable energy growth on track, as flexibility contributes to balancing the grid, reducing curtailment, and ensuring a reliable electricity supply. It also reduces system costs.

Annual battery storage installation growth of 45% in 2024-2025 was driven by utility-scale batteries (with 55% share of 27.1 GWh), which SPE calls the ‘main engine’ of Europe’s battery storage expansion.

Around 63% of the total capacity was concentrated in the top 5 markets, namely Germany (6.6 GWh), Italy (4.9 GWh), Bulgaria (2.5 GWh), the Netherlands (1.7 GWh), and Spain (1.4 GWh), even though their share dropped from nearly 80% in the previous year.

“The strong uptake of utility-scale batteries in 2025 shows investors are ready, the technology is mature, and the system benefits are clear. But we must now dramatically accelerate deployment,” said SPE CEO Walburga Hemetsberger.

By 2030, the association recommends that the EU repeat a 10-fold increase, scaling the cumulative capacity to around 750 GWh to meet its energy flexibility needs.

Hemetsberger added, “To support EU security and competitiveness, we need a battery fleet capable of supporting a fully flexible, renewable based energy system.”

For this, analysts remark, the bloc needs to invest in battery manufacturing. In 2025, the nominal battery cell production capacity here was 252 GWh, of which around 92% serves the electric vehicle (EV) market, and 70% of it consists of nickel-based batteries.

“This is expected to change over the coming years as demand for stationary storage continues to rise and lithium iron phosphate chemistries dominate the market. Europe holds a substantial pack and module assembly capacity, with nearly half of all factories located in Germany, and less than 20% serving the stationary storage market,” points out SPE Executive Advisor and Director of Market Intelligence and Project Lead for this report, Michael Schmela.

He adds that project delays and high production costs are still hurting the EU’s competitiveness in battery storage, highlighting the need for a stronger, fully integrated European battery value chain.

The report writers recommend 3 key priority areas of focus for EU policymakers to boost the bloc’s battery storage industry:

Accelerate BESS deployment by streamlining permitting and licensing; prioritizing grid-friendly assets in grid-connection queues; and fixing tariff barriers and enabling fair access to all power markets.

Building affordable and resilient supply chains by supporting manufacturing with targeted investment and innovation; strengthening access to critical raw materials for the industry; and developing strategic global partnerships to diversify supply.

Strengthening quality, safety, and sustainability by harmonizing EU-wide safety standards and incident reporting; improving rules for recycling and 2nd life batteries; and implementing robust carbon-footprint disclosure across the value chain.

The complete report is available for free download on SPE’s website.