Key takeaways:

Becquerel Institute examined integrated PV (IPV) applications in the EU and estimated the capacity of individual IPV applications

The results show very different scaling trajectories, with agri-PV and BIPV offering the highest long-term potential

Regulation, land-use rules, and integration constraints play a decisive role in narrowing theoretical PV potential to realistic market adoption

At the TaiyangNews Advanced Solar Module Applications Conference 2025, Juan Martinez from the Becquerel Institute shared insights from the Seamless-PV project under Horizon Europe. The project focuses on Europe and examines where integrated PV (IPV) solutions could realistically scale between now and 2050.

Martinez framed the discussion around IPV applications that embed solar into buildings, infrastructure, agriculture, and vehicles. The underlying idea of an IPV is its dual functionality: generating electricity while serving other purposes, such as land-use optimization, weather protection, noise reduction, mobility, and so on. Within Seamless-PV, the analysis covered building-integrated PV (BIPV), infrastructure-integrated PV (IIPV), such as carports and noise barriers, agri-PV, vehicle-integrated PV (VIPV), and lightweight modules.

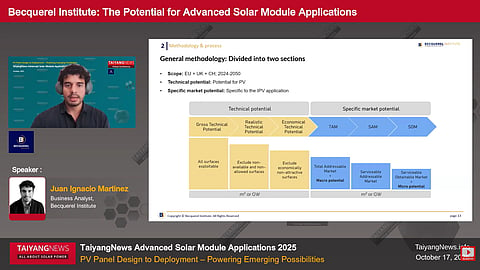

Becquerel Institute followed a methodology to estimate the market potential for each of these IPVs, where the study first assessed the technical potential, which is the theoretical PV capacity that could be installed based on available surface area. It was then narrowed down to specific market potential, accounting for constraints unique to integrated applications, such as architectural limitations, renovation cycles, shading, irradiation, and integration feasibility. The study finally applied an innovation-diffusion model to reflect realistic adoption rates to determine the serviceable addressable market (SAM) for each of BIPV, IIPV, agri-PV, VIPV, and lightweight PV.

For BIPV, the results show a significant, steadily growing opportunity, especially with renovation activity. The study considered new construction and renovation as 2 scenarios for this IPV. Even after applying architectural and irradiation constraints, the institute estimates that BIPV could reach close to 140 GW by 2050 under a strong renovation scenario and over 90 GW in a non-renovation or new construction case. Roofs account for most of this potential, but façades make up a significant share. Notably, the study suggests that BIPV will not reach market saturation by mid-century and will likely continue growing beyond 2050.

PV carports, especially the commercial ones, emerged as another strong segment. Both residential and commercial carports show considerable technical potential. Commercial applications dominate after applying economic and adoption constraints. Open layouts, fewer shading obstacles, and clear business cases (using EV charging) make commercial carports more attractive. With supportive regulation, commercial carports are estimated to exceed 100 GW by 2050, while residential carports are expected to remain a niche.

In contrast, PV noise barriers show limited potential. Although Europe has extensive highway and railway networks, only a small portion of it is suitable for noise barriers, and much fewer locations justify PV integration due to cost and design constraints. As a result, PV noise barriers are expected to grow slowly and remain a niche application, reaching well below 0.5 GW by 2050, with most installations concentrated in countries such as Switzerland, Germany, and the Netherlands.

Agri-PV stands out as the most significant opportunity by far. Even after excluding protected areas and environmentally sensitive land, the remaining agricultural area in Europe represents an enormous technical potential of about 75 million hectares. Depending on regulatory strictness, SAM for this IPV ranges from over 1 TW under strict regulation to more than 3 TW under loose regulation by 2050. However, Martinez emphasized that this segment is highly dependent on policy frameworks. Adoption is expected to accelerate after 2035 as regulations mature, technology improves, and farming practices adapt to coexist with PV.

For VIPV, the outlook is more long-term. Vehicles have a limited usable surface area, and the integration complexity, cost, and shading constraints limit near-term adoption for solar. However, VIPV could reach between 7 and 17 GW in Europe, driven by electric-vehicle penetration and advances in lightweight, flexible module design. This growth is also in alignment with Europe’s mobility decarbonization goals. The study does not expect meaningful scale before 2040, positioning VIPV as a future rather than an immediate opportunity.

Martinez also highlighted lightweight PV as a complementary solution. These modules, over 50% lighter than conventional glass-glass modules, can be installed on structurally constrained roofs without full integration. The Becquerel Institute estimates a potential of more than 85 GW in commercial and industrial buildings, with countries such as Spain, Germany, the Netherlands, and Italy leading in its adoption.

In closing, Martinez emphasized that across all segments, regulation, integration feasibility, and technological maturity will determine how much of the theoretical potential is realized in actual installations. Together, these IPV applications could add hundreds of gigawatts of capacity by 2050, while helping Europe with its decarbonization goals. Martinez’s full presentation, titled The Potential for Advanced Solar Module Applications, can be accessed here.