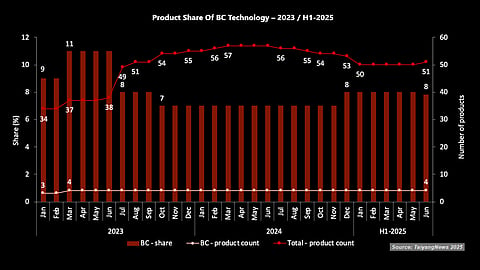

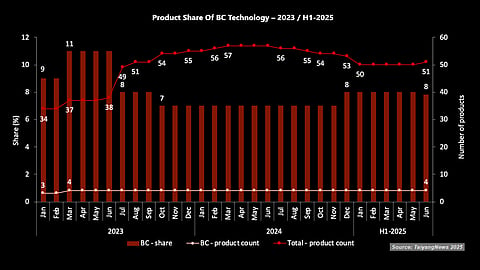

BC remains the efficiency leader but continues to be the least represented cell technology, with 4 products listed

In H1 2025, BC’s share stayed stable at 8%, unchanged from December 2024

BC module presence has been limited since 2023, with the share fluctuating between 7% and 11%

Analyzing efficiency progress by cell technology adds another layer of insight. While efficiency band trends provide a broader picture – since each cell technology generally falls within a specific range – there are always exceptions, and the finer details can be quite revealing. TaiyangNews TOP SOLAR MODULES Analysis H1-2025 report presents a more in-depth look at the progress of each cell technology (see Technology Shares In Solar Module Efficiencies).

Starting with BC, the efficiency frontrunner held onto its top position but remained the least represented among solar technologies. Its limited presence underscores both the technology’s exclusivity and the small number of companies capable of bringing it to market.

In the first half of 2025, BC technology maintained a stable presence, with 4 products listed each month and a consistent 8% share. These same 4 BC products – from AIKO, Maxeon, LONGi, and SPIC – continued to represent the technology throughout the period.

In 2024, the situation remained unchanged. The same 4 BC products were listed throughout the year, with the segment holding a steady 7% share from January to November. This rose slightly to 8% in December, primarily due to a decline in the total number of listed products. The BC segment was represented by the same 4 entries for most of 2023 as well, with no new additions following AIKO’s entry in March of that year. BC’s share did fluctuate somewhat in 2023. It started at 9% in the first 2 months, peaked at 11% around mid-year, and then gradually declined to 7% by December.

This text is an edited excerpt from the TaiyangNews TOP SOLAR MODULES H1-2025 report, which can be downloaded for free here.