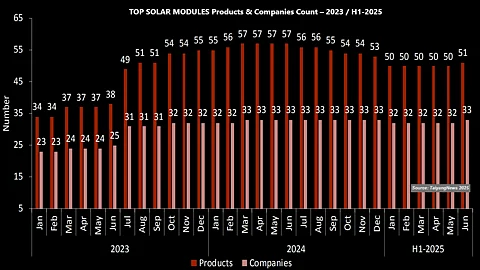

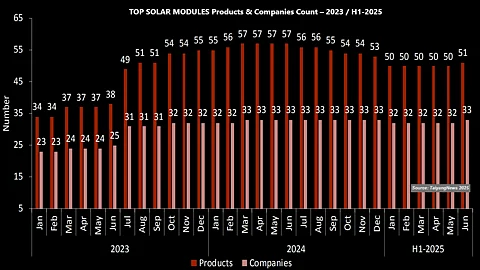

TOP SOLAR MODULES peaked at 57 in March 2024, declined to 50 by early 2025, and inched back up to 51 in June 2025

The number of listed companies stayed nearly stable, fluctuating between 32 and 33 during this period

While 19 companies offered products across 2 technologies in 2024, this dropped to 17 in H1 2025; only one company, URECO, was active in 3 technologies by mid-2025

An important feature of TaiyangNews’ TOP SOLAR MODULES is that we have been ranking the companies according to their efficiency levels, and companies have always been striving to reach the top positions. It is interesting to see how the top 3 efficiencies have progressed in the last 2 years, as well as the companies that led these innovations. Efficiency is one thing, but cell technology also plays a role here. Thus, we have also analyzed the toppers of 4 cell technologies – BC, TOPCon, HJT and PERC. This article provides an analysis of the top 3 efficiencies over time and the top efficiencies in each cell technology, and the respective companies that attained this level.

Before going into the core analysis, here is a quick peek into the statistics of the TOP SOLAR MODULES over the last 2.5 years. In terms of count, the most notable development in H1 2025 is also the latest, occurring in June, when the number of products increased – albeit by just one – after not changing for several months. The June edition also marked the entry of a new company, Jetion Solar, into the TOP SOLAR MODULES list. This is the first new company to join the list since Grand Sunergy’s entry in October 2024, which followed Kalyon PV’s addition in March 2024 (see TOP SOLAR MODULES Listing – June 2025).

As to the product count, the number remained same from January through May 2025at 50, after a considerable drop in January due to the delisting of 3 products. The June update took the total to 51. In H2 2024, the number of listed products started decreasing, dropping to 56 in July from a peak of 57, and ultimately to 53 by December 2024. This was mainly due to a few companies ceasing their commercial activities in the PERC technology stream. A total of 5 products were delisted in H2 2024. In contrast, it was only an upward trend until then. It was in March 2024 that the peak of 57 was achieved, and continued until the end of H1 2024, increasing from the January level of 55 at the beginning of 2024.

Looking back, starting from 34 in January 2023, the number of listed products grew to 55 by December 2023. This growth was part of a steady rise observed since the start of our TOP SOLAR MODULES feature in January 2022 until H1 2024.

The growth story is slightly different when it comes to the number of companies. As mentioned earlier, the most notable change in H1 2025 occurred in June with the addition of Jetion Solar, which brought the total number of companies back to 33. The count had dropped to 32 in January 2025 due to the delisting of Akcome.

In 2024, the total number of companies increased by just one over the entire year – from 32 in January to 33 in December. Kalyon PV was added in March, and Grand Sunergy entered the list in October. However, this second addition was offset by the delisting of Talesun in the same month, so the overall company count remained unchanged at that time.

The clear disconnect between the changes in the number of products and suppliers indicates that more manufacturers were expanding their portfolios across multiple technologies to achieve module efficiencies above 21.5%. For instance, during H1 2025, 17 companies offered module products based on 2 different technologies, while one company was represented in 3 technologies. Of late, though, the number has been declining. Regarding companies represented in 2 technology streams, the count remained steady at 19 throughout 2024. The dip during H1 2025 was due to the omission of Akcome from the TOP SOLAR MODULES list and the delisting of PERC products from Risen. Consequently, the number of companies offering modules based on 2 different technologies dropped from 19 in December 2024 to 17 during H1 2025.

The number of companies featuring products across 3 different cell technologies decreased to 1 from 3 already during 2024. Tongwei Solar, previously part of this category, exited the PERC segment in August 2024, while Canadian Solar exited the HJT category in March 2024, leaving URECO as the only company with listings across 3 technologies for the remainder of 2024, as well as for H1 2025.

In 2023, 11 companies offered modules using 2 technologies, typically combining PERC with either TOPCon or HJT. No company had products across 3 technologies that year.

This text is an excerpt from the TaiyangNews TOP SOLAR MODULES H1 – 2025 report, which can be downloaded for free here.