PV Module Encapsulation Technology Update

- The rise of bifacial module technology has challenged the dominance of EVA as main module encapsulant, as it is less effective in protecting against PID and acid formation

- The industry is adopting the coextruded EPE structure, consisting of a POE film sandwiched between two layers to reduce consumption of POE resin

- While EPE is being used to reduce costs, the pure POE films still play a crucial role in advanced cell architectures such as TOPCon

As our tastes Market Survey on Backsheets & Encapsulation shows, the encapsulants segment is quite different and rather limited in terms of choices among the polymer chemistry. EVA has been synonymous with encapsulation and enjoying a monopoly since the beginning days of solar manufacturing. While there were several other products introduced to the market such as PVB, TPU and silicones, they were all pushed into niche, as none of them could match EVA's outstanding cost performance ratio. This paradigm has been somewhat challenged with the advent of bifacial module technology. EVA also has some limitations such as acid formation and less protection from PID, which are prominently seen in the glass-glass structure of bifacial modules. Filling these gaps, POE has become an effective alternate to EVA, gaining the limelight along with the widespread adoption of bifacial technology.

For our the encapsulant part of our latest Market Survey on Backsheets & Encapsulation, we have received also inputs from encapsulant component (POE resin to be specific) supplier Dow. While Dow is also promoting an innovative encapsulation solution based on silicones, it is outlined in the section on trends in encapsulation. Coming to the most important developments, Caroline Grand, Scientist, Dow Packaging & Specialty Plastics, based in Europe (Tarragona, Spain), says that two things stand out from the perspective of a POE resin supplier. One is advanced cell technologies such as TOPCon and HJT that are benefiting from the POE encapsulation technology. "We foresee a greater market uptake for POE on account of these cell technologies," said Grand. The other is a more geographical trend in the sense that Dow sees a shift of module production from Asia, especially China, to other parts of the world such as Europe, Middle East and North America. The shift is also facilitating local production of materials including encapsulants, according to Grand. "Although in the early stages, and volumes are a fraction of what is produced in Asia, the trend is clear and it's coming," said Grand. She emphasizes that production lines for encapsulation film are already either being set up or being transformed to serve the market. In Feb, 2023, Dow has expanded its DOWSIL line of silicone-based products adding 6 sealants and adhesives solutions to be used for frame sealing, rail bonding, junction box bonding and potting for solar PV module assembly and building integrated (BIPV) installation materials (see New Silicone Sealant Products For PV).

As to the innovations at the product level, the topics are much similar to those expressed in the previous edition. The most important one is improving the resin processability to enhance POE film production rate. Another one is adding value for module makers. The topics of focus here are faster curing rates of POE film that can reduce lamination time in module fabs and POE compatible with MBB – avoiding slipping of round interconnection and reducing costs. Dow's resin can also be used for producing thermoplastic polyolefin encapsulants. Emphasizing the high-quality POE over EVA, Dow Chemical's PV Application Technical Leader Yuyan Li presented the company's ENGAGE PV POE based encapsulant solutions for high efficiency bifacial modules at TaiyangNews Reliable PV module Design Conference 2022 (access presentation here).

At the product level, the main encapsulation materials are EVA and POE, each of which are available in 2 leading variants. While EVA has fundamentally been transparent, it has been tweaked to become white EVA in order to improve the optical gains of the module with increased reflections from cell gaps. POE, typically used on the rear side of p-type PERC bifacial modules, is increasingly being replaced with a coextruded multi-layer structure consisting of a POE film sandwiched between two layers of EVA. This structure is called EPE. The main motivation is to reduce the costs as the POE resin is quite expensive at about 330,000 RMB/ton. While the resin price for EVA also hit its all-time peak in 2021 to about 300,000 RMB/ton, in late 2022 it is was selling at a lowly 15,000 to 20,000 RMB/ton. In order to reduce the consumption of expensive POE resin, the industry is more and more adapting to the EPE structure in place of pure POE films, especially on the rear side of PERC modules, which are still dominant. On the other hand, pure POE films are again gaining importance for advanced cell architectures such as TOPCon as typical EPE films are not able to provide the required reliability.

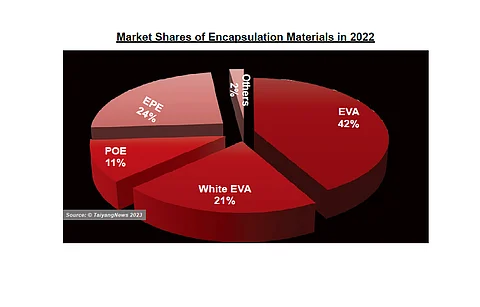

As to shares of these types of encapsulants, as in the past, transparent EVA is still dominating the segment with a market share of 42% in 2022, while white EVA is gaining ground at 20%. The share for POE as in a pure film form was 11%, while the EPE has enhanced its presence, representing close to a quarter of the market, leaving a meager 2% market for other encapsulation solutions.

The article is an except from the TaiyangNews Market Survey on Backsheets and Encapsulation 2022-23, which can be accessed for free here.

.png?w=50&fm=png)