Despite the growing interest in the technological aspect of the building-integrated PV (BIPV) technology for which Australian research institutes and industries have been developing scientific knowledge, the practical use of the technology in the market remains limited.

This is the assessment of a new Task 15 report of the International Energy Agency Photovoltaic Power Systems Programme (IEA PVPS). Titled Analysis of the Technological Innovation System for BIPV in Australia 2024, it looks at the status of the BIPV industry in the country in terms of its strengths and weaknesses.

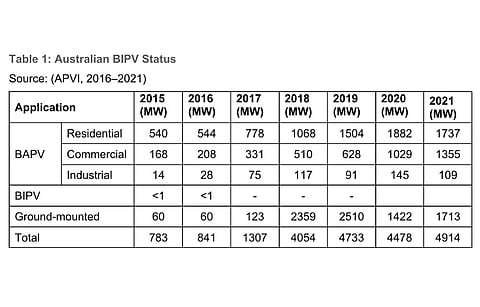

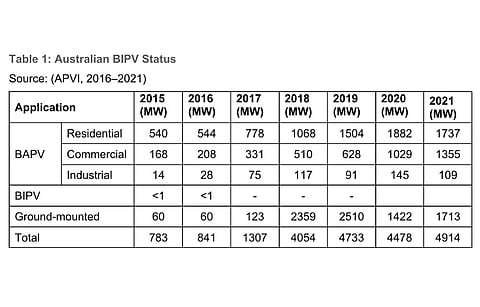

From initially being installed in non-domestic buildings around the year 2000 with government aid, BIPV in Australia hasn't really taken off as expected. Between 2015 and 2021, Australia saw installations of less than 1 MW BIPV capacity as per the Australian PV Institute (APVI).

Their share as integrated within roof tiles or roof sheets in domestic buildings is growing but this is poorly documented, points out the IEA PVPS report.

It explains that the BIPV-integrated roof sheets, tiles, skylights and rainscreens operate in a niche market, whereas others, such as balustrades, curtain walls and windows, are in the demonstration phases.

Due to knowledge gaps, its uptake remains low even though, as the report writers point out, several actors such as the building and construction sector, PV sector, utility/energy sector and property sector, exist in the upstream and downstream value chains of BIPV in Australia.

Assessing the country's BIPV market in 8 functional areas with technological information systems (TIS) analysis, the IEA PVPS found that there is a lack of knowledge development in Australia in this space. The knowledge pool exists within a small circle of academia and industry players, but this knowledge diffusion to other stakeholders remains poor.

Another limited factor is the limited resource availability related to BIPV in terms of experts, resources and funding opportunities for upstream and downstream suppliers.

Additionally, the report writers see limited market entrances and low demand as negatively hampering entrepreneurial experimentation in the BIPV space. Nevertheless, there are opportunities for growth as entrepreneurs can introduce various BIPV applications for different market segments.

The market needs regulatory support in terms of institutional framework with regulations complying with building codes. These are especially important for fire safety and structural loads.

The report writers recommend a series of measures for the uptake of BIPV in Australia. Measures suggested include forming a BIPV alliance to create a common platform to link actors. There is also a need to introduce a live lab to test modules and systems. The government also needs to step in to support both upstream and downstream players to encourage development of a reliable supply chain.

As for other stakeholders in the BIPV domain, IEA PVPS recommends architects, BIPV consultants and developers to reduce the cost of BIPV construction with design optimization and demonstration projects.

Training schemes to equip building workers and professionals to reduce reworks, occupational risks and unnecessary expenses is also an important aspect.

The complete report is available for free download on the IEA PVPS website.

In one of its earlier reports on BIPV, IEA PVPS had pointed to the lack of awareness among industry professionals as a limited factor in its uptake globally. It recommended digitalization, especially in urban settings, to increase its acceptance (see IEA PVPS Report Investigates BIPV Digitalization).