Monitoring the top-ranked module efficiencies over time shows how overall benchmarks have advanced and identifies the companies that consistently remained among the efficiency leaders

Progress among the top 3 modules is closely linked to the development of BC, TOPCon, HJT, and PERC architectures

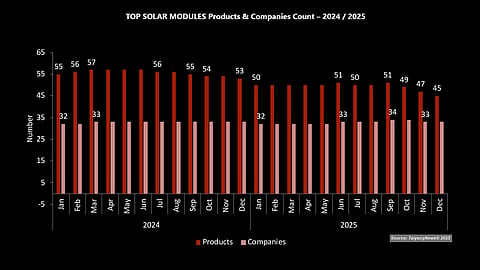

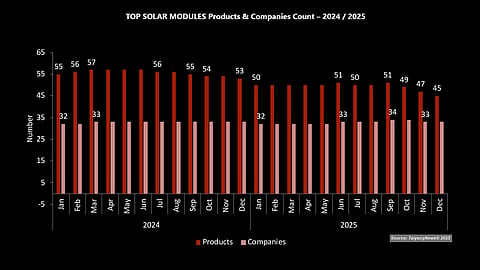

Over the last 2 years, product counts decreased mainly due to PERC delistings, while the number of companies represented in the TOP SOLAR MODULES list remained largely unchanged

Efficiency is at the core of TaiyangNews TOP SOLAR MODULES listing, with companies being ranked according to their top product efficiencies. Tracking these rankings over time reveals not only how the industry’s efficiency benchmarks have advanced during this period, but also the companies that have been at the forefront of pushing those limits. To reflect this, our analysis examines how the overall top 3 efficiencies have progressed over the scope of this report, i.e., the last 24 months. While headline efficiency numbers tell part of the story, the underlying cell architecture is the most critical in enabling these high levels. Thus, we also analyzed how the top 3 of each of today’s mainstream cell technology – BC, TOPCon, HJT, and PERC – based modules have progressed in the last 2 years (see Tracking What Truly Reaches The Market).

Count of Companies & Products

To set the context for the analysis that follows, here is a quick snapshot of how the TOP SOLAR MODULES landscape has evolved over the last 2 years, especially with respect to the count of companies as well as listed products.

With yesterday’s advanced technologies, such as TOPCon, becoming mainstream, several leading manufacturers have ceased development activities – and a few have even stopped commercial activities altogether – with PERC. Thus, the delisting of PERC products is one of the most prominent changes.

Starting from where we left off in the previous report, H2 2025 began with 50 products listed under 33 manufacturers. Over these 6 months, 7 modules were delisted, and 1 new company was added to the list. In July 2025, a PERC module from EGING PV was removed. This did not impact the number of listed companies, as it was the manufacturer’s second product on the list. The first addition to occur in H2 2025 was DAH Solar’s TOPCon product in September. The following month marked a more pronounced contraction, with 2 products delisted, including a TOPCon module from Qn-SOLAR and a PERC module from JA Solar. A further reduction followed in November, when a longstanding BC module from Maxeon Solar was removed from the listing. In the same month, a PERC module from DAS Solar was also delisted. The year concluded with additional removals in December, when 2 more PERC modules, one each from Canadian Solar and GCL SI, were taken off the list, bringing the total number of listed products to 45 by the end of the year.

Developments during H2 2025 did not materially alter the overall number of companies represented in the TOP SOLAR MODULES list, despite multiple changes at the product level. Following the addition of Jetion Solar in June, the total number of companies stood at 33 as the second half of the year began. In September 2025, DAH Solar became the only new company to enter the list, temporarily increasing the company count to 34. No companies exited the list during H2 2025. As a result, the number of listed companies remained within a narrow range of 33 to 34 throughout the second half of the year, closing December 2025 at 33. Product delisting during this period did not translate into company-level exits, as these manufacturers continued to be represented by other listed products.

As for the first half of the year, the addition of Jetion Solar in June was the only notable development. This was the first new company to join the list since Grand Sunergy’s entry in October 2024, which followed Kalyon PV’s addition in March 2024. From January through May 2025, the number of listed products remained unchanged at 50, after a notable drop in January due to the delisting of 3 products. The June update took the total to 51. The addition of Jetion Solar brought the total number of companies back to 33, which had dropped to 32 with Akcome’s delisting in January 2025.

Looking further back, the number of listed products began to decline in H2 2024, falling to 56 in July from a peak of 57 and ultimately to 53 by December. This reduction was mainly due to companies exiting commercial activity in the PERC technology stream, resulting in the delisting of 5 products in H2 2024. Starting the year at 55 products, the trajectory was largely upward, hitting a peak of 57 in March 2024, which remained constant through the end of H1 2024. Among the additions in 2024 were Kalyon PV in March and Grand Sunergy in October, while the delisting of Talesun that same month meant a net addition of 1, bringing the total to 33 (see TOP SOLAR MODULES 2025: Badge Of Excellence).

Overall, there is an apparent disconnect between changes in the number of products and suppliers. This indicates that more manufacturers expanded their portfolios across multiple technologies to achieve module efficiencies above 21.5%. On the other hand, this list is shrinking as more and more companies withdraw their PERC products. The number of companies listed under 2 cell technology streams during the second half of 2025 totaled 10, and 1 company represented in 3 technology streams.

During H1 2025, 17 companies offered module products based on 2 different technologies, while 1 company was represented across 3 technologies.

Throughout 2024, a total of 19 companies were represented in 2 technology streams. The number dipped to 17 during H1 2025 with the omission of Akcome and the delisting of PERC products from Risen. The number of companies featuring products across 3 different cell technologies decreased from 3 to 1 during 2024. Tongwei Solar, previously part of this category, exited the PERC segment in August 2024, while Canadian Solar exited the HJT category in March 2024, leaving URECO as the only company with listings across 3 technologies for the remainder of 2024, as well as for H1 2025. In 2023, 11 companies offered modules using 2 technologies, typically PERC and TOPCon or HJT. No company had products across 3 technologies that year.

The text is an edited excerpt from TaiyangNews’ latest TOP SOLAR MODULES Report 2025, which can be downloaded for free here.