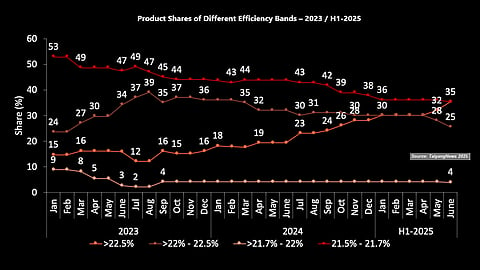

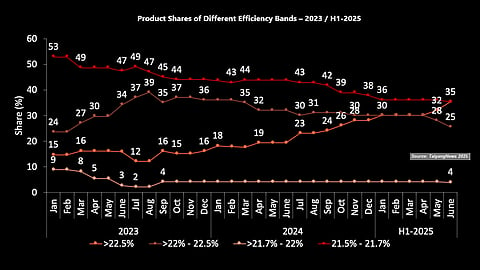

Module efficiencies are tracked across 4 bands: >22.5%, >22% to 22.5%, >21.7% to 22%, and 21.5% to 21.7%

The >22.5% band hit a record high in June 2025 with 18 products, accounting for 35% of all listings, tripling since early 2023

The >22% to 22.5% band declined to a share of 25% in June 2025

The 21.5% to 21.7% band, dominated by PERC, fell from 53% in early 2023 to 35% by June 2025

Starting off with numerical data, this article provides a 2.5-year overview of the efficiency development of the different products listed in TOP SOLAR MODULES, categorized into the 4 efficiency bands described above.

The >22.5% efficiency band continued to expand in H1 2025, with its share increasing from 30% in January to 35% by June. In January, although the number of products in this band remained at 15, the overall decline in total listed modules resulted in a higher share. The count stayed stable till May, when one more company entered this high-efficiency category. In June, there were 2 additions. With 18 products out of a total of 51, June marked the first time the highest efficiency band achieved its largest representation yet – 35% – alongside the lowest efficiency range of 21.5% to 21.7%.

This upward movement follows a year of gradual growth in 2024, where the band started at 18% in January – an increase of 2% over the previous month – then rose to 26% by October, and reached 28% by December. The gains were supported by more manufacturers commercializing modules above the 22.5% threshold, mainly based on BC and TOPCon cell architectures.

The momentum for this band, however, was not as prominent in 2023. The year began with a 15% share in January and saw a dip to 12% in July and August, before starting an upward trend and reaching 16% by the end of the year. This category transitioned from a premium niche into a major segment of high-performance offerings.

This band has more than tripled in absolute number since January 2023, growing from 5 products with a 15% share to 18 products accounting for 35% of the listings by June 2025. The rise reflects a clear trend of manufacturers adopting BC and TOPCon-based architectures to push module efficiencies beyond 22.5%.

Interestingly, the development progress in the next band – >22% to 22.5% – has been inversely proportional to one above it. For H1 2025, the share of this band was consistent at 30% for the first 4 months. As discussed above, Trinasolar improved the efficiency of its product from 22.5% to 23%, as a result of which, Trinasolar jumped to the higher band, causing a reduction in the share of this band to 28%. Then, it was GCL that upped the efficiency of its TOPCon module from 22.3% to 22.53%, which led to a decrease in share to 25%.

The band also followed a declining path throughout 2024 – from 36% to 30%. In contrast, in 2023, especially at the beginning, it was on the rise. Starting at a 24% share in January, this band hit a peak of 39% in mid-2023 – August to be precise – and then began a slow decline to 36% by the end of 2023 (see Top Efficiency Of Each Cell Technology In H1 2025).

This is the band where products from many companies started out with high-efficiency technologies such as HJT and TOPCon. But as they gained expertise eventually, companies improved the efficiency levels of these products and started commercializing modules with much higher efficiencies – a few even beyond 22.5%. This phenomenon explains the fall in the ‘>22% to 22.5%’ efficiency band and the rise in the band above, especially toward the end of 2023 and throughout 2024.

The >21.7% to 22% band has had the lowest representation. In H1 2025, the share of modules in this efficiency band remained constant at 4% from January through June. The number of products in this category stayed at 2, with no additions or removals during this period. The situation was similar in 2024, where the band consistently held a 4% share throughout the year. There was no change in product count or relative position in the listing. This category continued to represent a small group of modules that were either early versions of higher-efficiency designs or products not further developed. In 2023, the share was a little dynamic. It began at 9% in January, fell to 2% by July and August, and then improved slightly to 4% by December. The early drop was due to modules being removed or upgraded, while the later increase reflected a few entries into the range. However, the band’s overall representation remained relatively low.

The 21.5% to 21.7% efficiency band is almost exclusively represented by PERC products, especially since 2024. In H1 2025, the share of modules in the band declined slightly from 36% in January to 35% in June, with no new product entries during this period. That being the case, it still remained one of the most populated bands, reflecting the residual presence of PERC modules still active in the market. Throughout 2024, this band showed a clear downward trend. It started the year with a 44% share in January, plateaued at that level during the first half, and then declined to 38% by December. The decline in the latter part of the year was due to the delisting of 5 products, as the respective companies ceased production of PERC products and took them off the market. With no new companies entering this band, its share could not be replenished, accelerating the fall. The year 2023 marked the beginning of this contraction. The band opened with the highest share of all categories – 53% in January – but declined steadily to 44% by December. The drop was mainly due to an increasing number of companies adopting advanced cell architectures and commercializing products with higher efficiencies, moving out of this band as a result. Accounting for the bulk of the listing during this period, the entry-level band of 21.5% to 21.7% was mostly represented by PERC, while one HJT module also remained part of it until August 2023.

This text is an excerpt from the TaiyangNews TOP SOLAR MODULES H1-2025 report, which can be downloaded for free here.

TaiyangNews hosts 2 upcoming conferences in September: the Cell & Module Production Equipment & Processing Materials Conference on September 2, 2025, free registration here, and Solar Made in the USA on September 8, 2025 in Las Vegas: register via RE+ here.