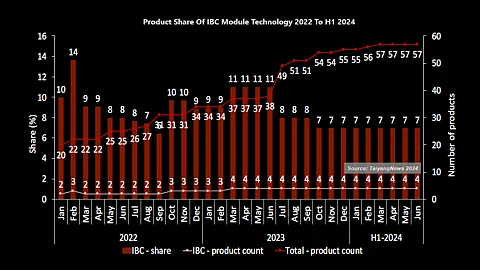

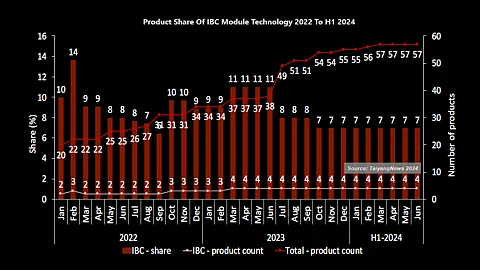

TaiyangNews previous article analyzed the technology trends of various cell technologies as of June 2024. Out of 57 products, 4 were IBC modules (7% share), 8 were HJT modules (14% share), 20 were TOPCon modules (35% share), and 25 were PERC modules (44% share). We next delve into each cell technology, starting with IBC (see Analysis Of Cell Technology Trends).

IBC, providing the highest efficiency, it had the lowest product count with 2 in January 2022and 3 in December 2022. Even with the addition of one product during 2023, the product count only increases to 4. With hardly any growth in the number of products, the technology’s share decreased from10% to 9% in 2022 and to 7% in 2023. This is an indication that only a few companies have been able to master IBC as a commercial technology.

Initially, it was mainly 2 companies in January 2022, LG and Maxeon, with LG exiting the solar industry in April 2022. In March 2022, SPIC's IBC product based on ISC Konstanz's Zebra technology also entered the market. This left Maxeon and SPIC as the sole suppliers of commercial IBC modules at the time. However, in November 2022, LONGi launched its HPBC, also built on the IBC platform, thus increasing the number of products to 3. In March 2023, Aiko also joined this elite club, increasing the count to 4 and its share to 11%. While the product count remained the same, IBC’s share declined to 7% from September onwards into H1 2024.

The TaiyangNews TOP MODULES H1-2024 Report summarizes the key findings from over 30 editions published during 2022 and H1-2024. Download the free report here.