Key Takeaways:

Trackers and bifacial modules complement each other, with bifacial technology now common due to cost parity with monofacial modules, enhancing energy output in large-scale projects

Government policies and investor confidence are driving tracker deployment globally, with significant adoption in markets like the US, India, Europe, and Brazil

Solar tracker market penetration has risen by at least 5% globally in recent years, with 90% of US utility-scale projects and 50-70% of European and Indian projects utilizing trackers.

As the world strives for a smooth transition to green energy sources and an increasing number of countries for energy autonomy, solar power takes center stage. Amid the continuous surge in solar demand, ancillary technologies such as trackers are attracting significant traction. In fact, trackers are rapidly becoming the new standard in the utility segment of PV applications in sunny regions, and increasingly beyond.

Several factors are driving this wide deployment of trackers – and bifacial is one. The majority of commercially produced solar cells are now naturally bifacial, and their manufacturing costs are on par with monofacial modules. This makes bifacial technology the logical choice for large-scale solar projects (see TaiyangNews Report on Bifacial Systems 2024). Trackers and bifacial technologies have undeniable synergies, where the combined effect surpasses the individual contributions of these technologies.

There have also been several developments in the tracker segment of late. Today’s trackers are much more advanced and have several hi-tech features. They are integrated with advanced algorithms and AI not just to track the sun, but to always explore the possibility of enhancing the energy yield at the end. Equipped with strategies to navigate challenging weather conditions, trackers are now breaking geographical and weather barriers, making installations at previously overlooked sites financially viable.

Trackers were in high demand especially during periods of high module prices, given their role in helping realize the target power of the project with relatively fewer modules compared to fixed-tilt mounting. However, these sun tracking systems are still finding a business case in the prevailing rock-bottom market price conditions. The projects, now requiring less on the CapEx side, may have higher budgets to invest in trackers, as in the end, trackers increase the energy yield, which is something every project owner is looking for.

The tracker segment is also enjoying a pull effect. Rodolfo Sejas, PV business development specialist at Axial, observed that investors and developers now possess more information about the feasibility and effectiveness of trackers, boosting confidence in their use. For example, in India, recent government tenders, including those from entities like NTPC, explicitly specify the use of solar trackers. It shows the pivotal role policy can play in steering the adoption of technologies. Streamlining the permitting processes in markets like Spain, Italy and France, as Sejas emphasizes, is yet another example.

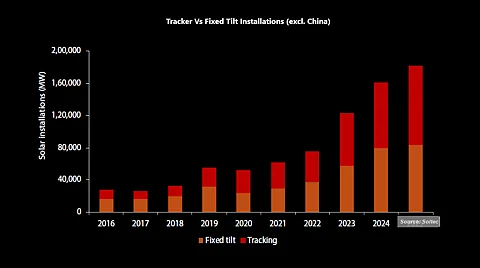

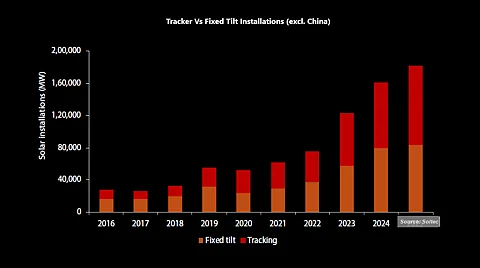

All this has led to widespread deployment of trackers, even in regions that historically favored fixed systems, such as India, parts of Europe, and South America. The global tracker market saw high growth in the last 2 years, especially in the US and Europe, and a few emerging markets in Asia-Pacific and Brazil. Solar tracker penetration in the global solar segment has increased by at least 5% in the last 2 years, contributed by some major markets like China, India, and Brazil, according to Sun Yun Hua from TrinaTracker. Many experts of the segment that TaiyangNews spoke to see the US as the top market for trackers with a share of more than 90% in utility applications. Speaking of Europe and Latin America, Sejas said that 50% of utility-scale installations consist of trackers, which he expects to increase to 55% to 60% in the coming years. Gonzalo Baselga Navarro, the chief business development officer at Gonvarri Solar Steel (GSS), sees a growing trend for European countries like Poland, Romania, and Hungary. In Spain, for example, while there's a mix of installations, a substantial portion, possibly 60% to 70%, employs trackers, he underscores. Shivranjan Jadhav, business development and sales manager at Scorpius, shares the Indian context that the reduced cost of bifacial panels over the last 3 to 4 years, combined with the knowledge that trackers can increase the energy yield by 20%, has paved the path for increased adoption of trackers in the country. Projects with a minimum size of 1 MW, accounting for more than 60% to 70% of the MW-scale projects, are opting for trackers, according to Jadhav.

The text is excerpt from the latest TaiyangNews Solar Trackers Market Survey 2024, which can be downloaded for free here.