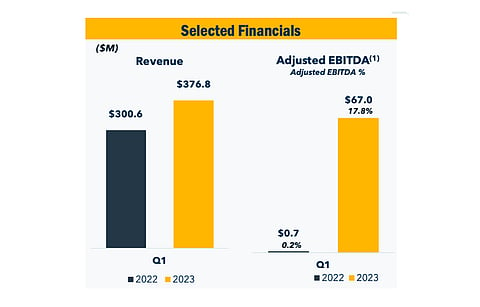

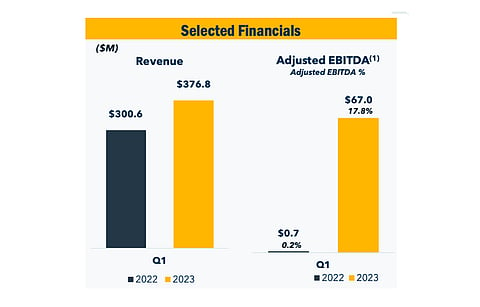

Solar tracker manufacturer from the US, Array Technologies improved its annual revenues for Q1/2023 by 25% to $376.8 million due to higher volume shipped and an increase in ASP due to 'improved pass through pricing' to the customers, but said its order activity slowed down as customers await final guidelines of the Inflation Reduction Act (IRA).

However, the revenues on quarterly basis slid down over 6% from $402.1 million for which the company previously announced were an improvement of 83% YoY (see Array Reports 92% Revenue Growth For 2022).

Higher volume also pushed up its gross profit on annual basis to $101.2 million, an increase of 281%, while gross margin went up to 26.9% from 8.8%. It turned profitable this quarter with $13.6 million net income, compared to -$37.5 million net loss last year.

At the end of March 2023, Array's executed contracts and awarded orders totaled $1.6 billion, comprising $1.3 billion from its legacy operations segment and $0.3 billion from STI Norland.

"I will note that we did have a slowdown in our order activity this quarter, which was not unexpected. Our pipeline remains strong, but many of our customers are still awaiting final IRA guidelines around domestic content before issuing final award and are delaying project start dates to provide more time to evaluate its provisions," pointed out Array CEO Kevin Hostetler.

However, Roth MKM says its checks with a developer, 3 EPCs and a large asset owner show that 'tracker orders have NOT been delayed by IRA'. Philip Shen of Roth referred to an EPC to say another US tracker maker Nextracker is winning against Array as it been 'consistently pricing 5-10% lower'.

Factoring in the delay, Array has now lowered the top end of its 2023 revenue guidance, but says it remains confident of its adjusted EBITDA, gross margin and adjusted EPS range forecast.

Full year 2023 revenue guidance now stands at between $1.8 billion to $1.9 billion, down from $1.8 billion to $1.95 billion (see Array's Order Book Till Dec 2022-End Was Worth $1.9 billion).

Array and the company it acquired, STI Norland are both featured in TaiyangNews' 2nd Market Survey on Solar Trackers, published in December 2022. It can be downloaded for free here.