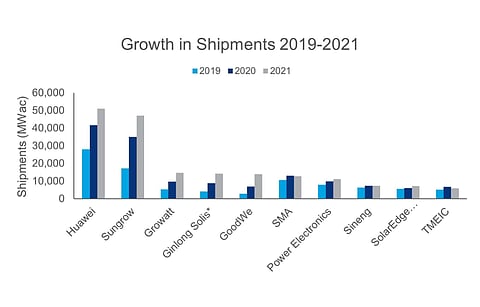

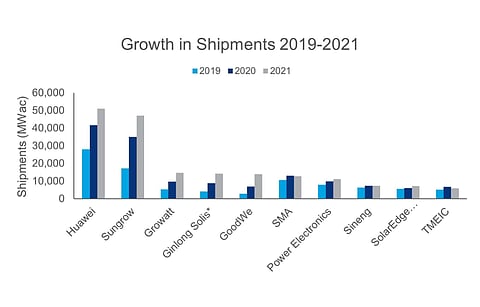

In 2021, global solar PV inverter shipments added up to 225.286 GW AC in 2021, having grown 22% or 40.25 GW AC on annual basis, thanks to strong growth supported by government policies in the markets of Europe, India and Latin America, says Wood Mackenzie.

The US market intelligence firm points out the growth in shipments despite 'soaring raw material prices, supply chain challenges and delayed construction'.

The market was led by Huawei with a 23% market share that was stable when compared to the previous year, followed by Sungrow with a 21% stake that grew from close to 19% in 2020 (see Sungrow Shipped 47 GW PV Inverters In 2021).

Another Chinese company, Growatt replaced SMA Solar to take up the 3rd spot with 7% market share, pushing the Germany company down to 6th spot. Together, the top 3 vendors accounted for 51% shipments in 2021.

On Wood Mackenzie's list, two other Chinese companies complete top 5 – and the country's dominance in the inverter field. On #4 is Ginlong Solis, followed on the 5th spot by GoodWe with China and South Korea taking a large amount of its inverters. It was also the year for GoodWe to witness its largest growth in shipments between pre-covid 2019 and 2021.

With Power Electronics from Spain ranked 7th there is a second top 10 inverter supplier from Europe. In total, there are 3 non-Chinese inverter manufacturers among the top 10 with Israel based SolarEdge being a new entrant to the list on 9th spot, and with 1 GW AC shipped in 2021, mainly in Europe.

Geographically, the demand was strongest in Asia Pacific that took 116.06 GW AC of overall inverter shipments last year, mainly in China, India and Australia where Huawei and Sungrow were also the largest sellers.

Around 23% of the total shipments went to Europe with 50.77 GW AC which was an annual increase of 52% where largest contribution came from Germany, Italy, the Netherlands and Poland. It was the US that saw 14% of the global market share that went down by 360 MW AC on annual basis, which was attributed by the analysts to supply chain constraints, record-level raw material costs and rising costs for developers.

.png?w=50&fm=png)