The business model Chinese solar power project developer ReneSola Ltd follows is that of developing a project to the stage where construction can begin by the EPC contractor, which in common business parlance is called Notice to Proceed (NTP). It is this NTP-focused business model that, as Philip Shen of Roth Capital Partners said, has protected the company from elevated input costs being experienced by many in the global solar industry of late.

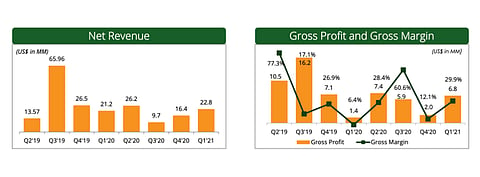

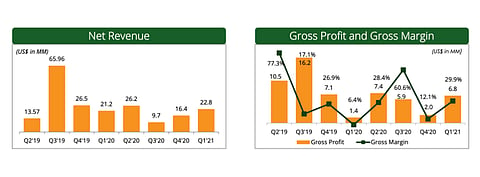

Hence, the company has reported $22.8 million revenues for Q1/2021, growing 39% sequentially and over 7% compared to the previous year (see ReneSola Grew Q1/2020 Revenues By 62% YoY). It was led by the project development business with $19.2 million contributions to total revenues, followed by $3.4 million from the independent power producer (IPP) business, primarily from the sale of electricity in China.

Gross margin went up significantly from 6.4% in Q1/2020 to 29.9% in Q1/2021, while net income was reported by the management as $0.8 million, turning profitable on annual basis after suffering a net loss of $-4.4 million a year back.

At the end of Q1/2021, ReneSola's late-stage development pipeline grew to 1.3 GW with most of it located in the US (340 MW), Poland (271 MW with 6 MW under construction), and the UK (209 MW), among other geographies. At the end of Q4/2020, this pipeline was 1 GW. By the end of 2021, it continues to aim to expand its total project pipeline to 2 GW (see ReneSola's 2020 Annual Revenues Dropped 38%).

In 2021, it is also targeting to expand its IPP assets by building 100 MW of solar power projects. It would mean a growth from 148.3 MW it currently operates in China in the distributed generation segment, and 24.1 MW in the US.

In a letter to shareholders, ReneSola's CEO Yumin Liu shared that the company is keen on expanding its solar project pipeline while further penetrating the solar+storage market. It would also be open to potential strategic merger and acquisition (M&A) opportunities.

"We are actively evaluating opportunities in both solar-plus-storage and independent storage facility solutions in the United States and United Kingdom. We are making good progress, and looking forward to capturing potential market opportunities," explained Liu.

Guidance

For Q2/2021, ReneSola expects its revenues to be within the range of $19 million to $22 million, and gross margin as 36% to 39%.

Focused on the strategic solar markets of the US, Europe and China where the local economies are said to be recovering from the impacts of COVID-19 and the regions are chasing away carbon emissions, for full year 2021 ReneSola has reiterated its previous revenue guidance of $90 million to $100 million, and gross margin exceeding 25%. "We expect a profitable 2021 with significant profit growth compared to 2020. This outlook reflects our strategy to focus on profitability and bottom-line growth."