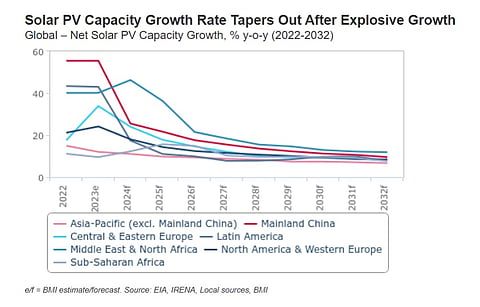

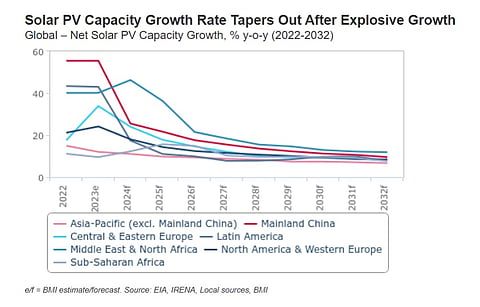

Easing of energy prices, emerging grid infrastructure limitations and waning of various government incentives is likely to slow down the installation of solar PV capacity post- 2024, according to BMI's latest outlook for global solar PV growth.

A unit of Fitch Solutions, BMI pegs the average annual growth of global solar PV capacity to drop down to 12.2% from 2024 to 2032. It will be a decline from the 'explosive' growth of 34.5% in 2023.

Analysts blame macroeconomic conditions for this slowdown across various geographies. In the US, California's Net Energy Metering 3.0 (NEM 3.0) has pulled down rooftop solar installations, while Poland's transition from a net-metering to a net-billing system has also lowered benefits for distributed consumers.

Grid capacity constraints are rising and will continue to pose challenge for new solar capacity to come up, caution the analysts. Solar curtailments during peak generation in Spain, for instance, pose investment risks despite the government's efforts to boost storage and interconnection capacities.

Analysts praise China that has directed 23 provinces to incorporate energy storage equivalent to 10% of their total capacity to increase grid-balancing capability to manage grid constraints.

Additionally, BMI sees Chinese oversupply of solar modules, thanks to the huge growth of PV manufacturing in the country last year, as presenting a risk to the diversification of global solar supply chain over 2024. This especially includes the markets of Europe, the US and India that have been trying to encourage domestic PV manufacturing at scale.

On Europe hoarding cheaper Chinese modules in bulk, BMI observes, "We believe this to be a reaction to the EU's ambitions to bolster domestic manufacturing, which signalled to developers potential price hike mechanisms on solar modules. However, since these price hikes mechanisms now seem unlikely, warehouses are seeking to offload these stockpiled solar modules at continued low prices, undermining the profitability of European solar PV manufacturers."

Several European solar manufacturers are already either shutting down businesses or evaluating options to survive with Chinese panels flooding warehouses here. According to InfoLink Consulting, Europe imported 101.5 GW of Chinese solar modules in 2023 but inventories are likely to be restocked as distributors eye geopolitical risks from the Red Sea issue (see China Exported 208 GW Solar Modules Globally In 2023).

SolarPower Europe too warns of slower expansion of solar PV in the European Union (EU) going forward (see EU Solar PV Installations Reach 56 GW In 2023).

The US too is experiencing significant price drops for solar modules adding uncertainty for investors that may delay development of manufacturing projects.

"We expect this significant fall in prices, as well as the uncertainty around the 2024 election will slow manufacturing development over 2024, resulting in continued Chinese dominance, and higher global supply chain risks," writes BMI.

Despite these geopolitical uncertainties, BMI expects solar PV to remain the leading renewables technology compared to the rest in several other geographies. It will account for 64% of all non-hydropower renewable installed capacity in 2032.

The Middle East and North Africa (MENA) region will see the strongest average annual growth rate of 21.1% after 2025 to add 68.4 GW solar till 2032.

China will continue to lead global net solar PV capacity additions, contributing 57% over the coming decade.