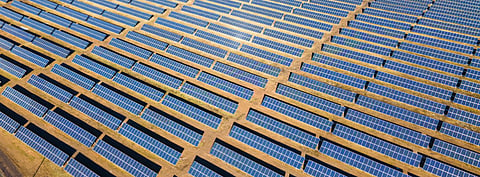

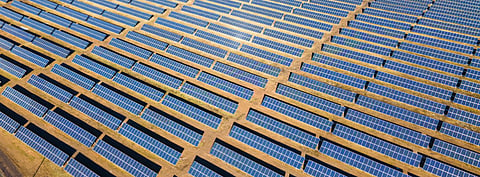

Capital Dynamics, the private asset manager with a global footprint, has created Arevon Energy, Inc. as a US based renewable energy company to support a standalone clean energy platform of 4.5 GW solar and battery storage capacity of operational, under construction and late-stage development assets, and another 3.0 GW pipeline.

Arevon Energy is a result of Capital Dynamics spinning off the members of its US Clean Energy Infrastructure (CEI) team, combining it with its exclusive energy asset management affiliate, Arevon Asset Management. The new entity will be led by hitherto a Senior Managing Director and Head of CEI at Capital Dynamics, John. Breckenridge as its CEO.

Arevon Energy will be 100% owned by an investor group comprising APG, the California State Teachers' Retirement System (CalSTRS) and a wholly owned subsidiary of Abu Dhabi Investment Authority (ADIA).

To be headquartered in Scottsdale, Arizona and New York City once the transaction is complete by early 2022 pending regulatory approvals, Arevon Energy has been formed to 'improve the structure and performance' of clean energy assets across North America with its financial capabilities and industry experience of its team.

Meanwhile, Capital Dynamics said it will continue to manage its CEI funds for assets spread across the US and Europe. The company is heavily invested in the US solar space. In July 2020, it announced a greenfield solar development partnership with Tenaska to develop 4.8 GW capacity in Midwest and Southeast US (see Capital Dynamics & Tenaska Join Hands For 4.8 GW Solar).