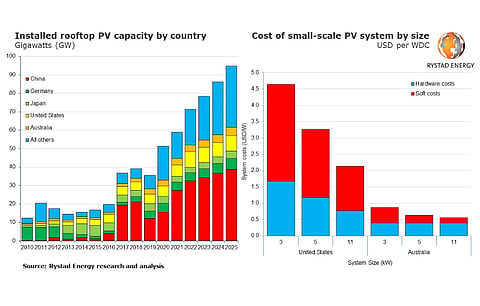

By 2025, global solar PV rooftop installations will nearly double to 94.7 GW, up from 59 GW at 2021-end, which already represents 30% of the global installed solar PV capacity, according to analysts at Norwegian energy research company Rystad Energy.

Incentives, and supportive policies introduced by governments including feed-in-tariffs (FIT) across the world have helped this solar segment to grow.

According to the analysts, recent growth was driven mainly by China where rooftop solar installations increased from 19.4 GW in 2017 to 27.3 GW in 2021 after having installed only 4 GW till 2016, and globally jumped by 64% from 36 GW in 2017.

Going in depth, Rystad Energy believes basis per-capita rooftop PV installations, Australia leads with 746W DC per person, followed by Germany with 668W DC and Japan with 353W DC.

"Small scale solar PV, including residential, C&I, and off-grid projects, are gaining momentum supported by economics and policies, with China, Japan, Germany, the US and Australia emerging as key markets," said Rystad Energy's Head of Renewables Research, Gero Farruggio. "Key drivers for the high uptake in the residential sector include high retail electricity costs, low system costs, high FiTs and the available roof space."

Analysts count Australia, the US and UK as the only countries among top 10 rooftop solar markets where most of the installations are dedicated for residential segment thanks to incentives and grants, along with availability of suitable space, and high proportion of homeowners.

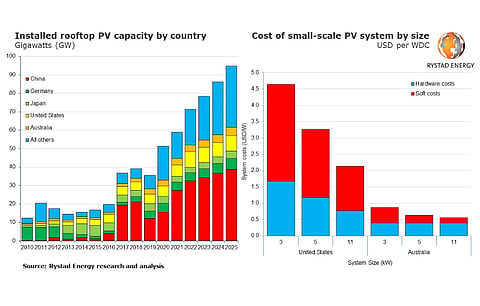

For the US and Australia, high proportion of homeowners is also a factor for its growth. Nonetheless, in the US a 3 kW system costs $4.6 per W DC compared with $0.96 per W DC in Australia. Significant soft costs associated with the system including sales tax, permitting, inspection, interconnection and profit margins, etc., make it an expensive proposition in the US as these account for 64% of the total cost for a 3 kW system.

"In addition to higher costs, the economics of residential systems are less favorable in the US given that retail electricity prices (costs being offset) are substantially lower – but this is state-dependent," state the analysts.

In Australia, 87% of the small-scale PV systems are used to power residential properties, while 13% are installed for commercial and industrial (C&I) use, while in the US 44% of the total installed capacity is for powering C&I properties and 56% residential despite the fact that the US has a population of 330 million compared to 26 million in Australia.