First Solar’s Q2 2024 net sales grew strongly with an increase in volumes

Net bookings grew by 900 MW since the last quarter results with 36 GW YTD

Citing policy uncertainty with regard to US elections, it will be selective in terms of new bookings

US solar module manufacturer First Solar exited Q2 2024 with strong growth in its net sales of $1.01 billion, thanks mainly to the 24% growth in volumes, and the payment from a European customer for contract termination.

Its shipments of 3.36 GW during the reporting quarter went up by 24% quarter-over-quarter (QoQ) and 21% year-over-year (YoY). Modules produced totaled 3.72 GW, compared to 3.63 GW in the previous quarter and 2.8 GW a year ago.

The company’s gross profit was strong at 49.4%, representing an improvement of 5.8 percentage points (ppt) sequentially, and 11.1 ppt on an annual basis. First Solar’s net income went up to $349.4 million. In the previous quarter, its net income totaled $237 million (see First Solar Begins 2024 With $237 Million In Net Income).

Bookings and backlog

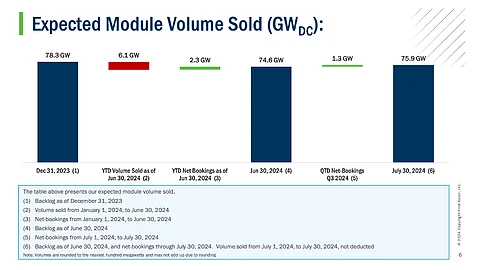

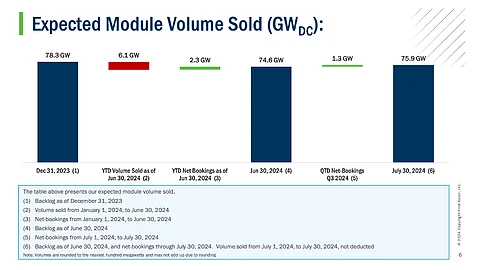

Since the company’s last earnings call, it had 900 MW of net bookings with an average selling price (ASP) of $0.316/W, including the 400 MW contract termination from an unidentified European customer. Its year-to-date (YTD) net bookings expanded to 3.6 GW.

At the end of July 30, 2024, its total contracted backlog and net bookings totaled 75.9 GW, extending through 2030.

The management also sees total booking opportunities of 80.6 GW, up about 7.8 GW since the last quarter. This comprises 28.6 GW at the mid-to-late stage, spread out as 24.6 GW in North America and 3.7 GW in India.

Policy concerns

During the call with analysts post the results announcement, First Solar’s CFO Alexander Bradley said the company will be ‘highly selective’ in its approach to new bookings in 2024. Since it is practically sold out with supply through 2027, he explained that uncertainty related to the policy environment in the US due to the upcoming Presidential elections is a major consideration for this strategy.

CEO Mark Widmar explained the environment of uncertainty translating into increased constraints regarding access to capital for the solar sector as financiers adopt a wait-and-watch policy till the election results are out.

Even developers, he added, are evaluating their risk and returns while oil and gas companies as well as utility developers are contemplating a ‘pivot from renewables to prioritizing fossil projects.’

For context, First Solar is referring to the stance of the Republican Party led by its presidential nominee Donald Trump, who clearly favors oil companies and believes climate change is a ‘green new scam.’ He is pitted against the presumptive nominee and the current US Vice President Kamala Harris from the Democratic Party that under Joe Biden’s leadership brought in the Inflation Reduction Act (IRA).

Recently, a Reuters report claimed that European companies investing in the US cleantech sector are ‘abandoning’ their expansion plans as they see funding for their US business in doubt if Trump clinches a victory.

In a May 2024 analysis, Wood Mackenzie said in case Trump comes back to power, he is likely to abandon the country’s 2035 net-zero target for the power sector that majorly centers around solar energy (see US Decarbonization Efforts Depend On Presidential Election 2024).

Nevertheless, First Solar expects the anti-China stance of the Republican campaign may mean that their government in power could lead to ‘incremental tariffs on the Chinese crystalline silicon supply chain operating from Mainland and through its Southeast Asia and other satellite countries.’ Additionally, the continued demand for utility-scale solar and the expected electricity demand from the growing data center industry, cryptocurrency mining, heating & cooling, etc., should contribute to the overall health of the PV industry.

Nevertheless, Philip Shen of Roth MKM anticipates a ‘steady train of policy tailwinds’ to continue supporting the company including wafer requirements for the domestic content adder, the AD/CVD investigation, and its TOPCon IP lawsuit (see First Solar Initiates Infringement Investigation).

Owing to these reasons, while it has left the FY 2024 guidance unchanged, the management expects the volumes sold, revenue and net cash guidance towards the bottom of the range.