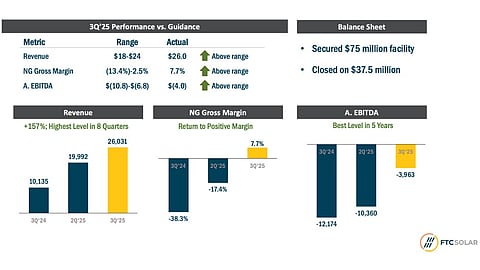

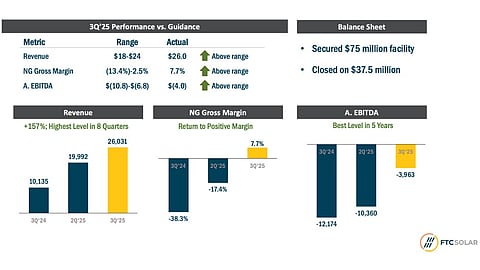

FTC Solar achieved revenues of $26 million in Q3 2025, up 156.8% YoY and 30.2% QoQ, calling it the company’s highest in 8 quarters

Its non-GAAP gross margin turned positive at 7.7%, marking its first profit since 2023

While adjusted EBITDA loss narrowed to $4 million, net loss widened to $23.9 million

FTC Solar, the US-based solar tracker systems company, beat its Q3 2025 revenue guidance and achieved a 30.2% sequential and 156.8% annual increase with $26 million. This was its highest level in 8 quarters.

Its non-GAAP gross margin profit of $2 million or 7.7% of revenue marked its return to positive gross margin for the 1st time since late 2023, while GAAP gross profit of $1.6 million, or 6.1% of revenue, compared to a gross loss of $3.9 million or 19.6% of revenue in Q2 2025 (see FTC Solar Improved Q2 2025 Revenues By 75% YoY).

The company President and CEO, Yann Brandt, said that the Q3 results came in above the high end of its guidance ranges in nearly all metrics. He shared that “… a more compelling and complete product offering helping to drive increasing traction with key existing and new customers.”

FTC Solar still reported a negative adjusted EBITDA but managed to narrow its loss to $4 million, compared to a loss of $10.4 million in Q2 2025 and $12.2 million in Q3 2024, and called it its best level in the last 5 years.

Its GAAP net loss of $23.9 million widened from the $15.4 million reported in both Q2 2025 and Q3 2024 (see FTC Solar Meets Q3 2024 Revenue Guidance; Offers Cautious Outlook For Q4).

FTC’s total backlog, comprising contracted and awarded orders, now stands at approximately $462 million, excluding the 1 GW tracker supply agreement with Levona Renewables announced in August this year. During the last quarterly results, management reported a backlog of close to $470 million, which was already a decline from $482 million in the quarter prior.

For Q4 2025, FTC projects revenues within the $30 million to $35 million range, with a non-GAAP adjusted EBITDA of $(5.4) million to $0.0 million. It expects revenue at the midpoint of the guidance range to be up approximately 25% compared to Q3.

FTC separately announced an agreement to acquire a 55% interest in Alpha Steel from its joint venture (JV) partners for around $2.7 million. In February 2023, FTC had launched Alpha Steel as a joint venture with its existing steel supplier, Taihua New Energy of Thailand, with an intent to build a steel fab in the US (see US Solar Tracker Maker Wants Locally Produced Steel).

“Following the closing of the transaction (which the company anticipates will be on November 12, 2025), FTC Solar will become the sole owner of Alpha Steel, LLC giving the company full control over a key contributor to its domestic content capability and additional profit potential, while ensuring compliance with guidelines included in the OBBB budget bill,” stated FTC.

Of the $75 million financing it secured in July 2025, FTC says it has now locked in $37.5 million and will be able to access the remaining amount at a later date, ensuring liquidity for the company.