FTC Solar’s Q4 2024 revenues increased by 30.2% QoQ, but declined by 43.1% YoY due to lower volumes

The company managed to narrow its GAAP net loss to $12.2 million during the reporting quarter

Its backlog of $502 million declined, but it managed several new contracts with tier 1 companies

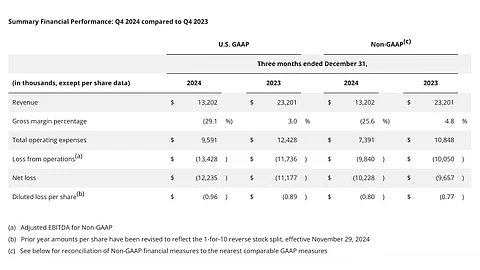

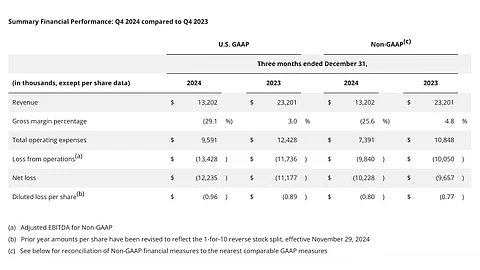

US-based solar tracker systems supplier FTC Solar has reported a 30.2% sequential increase in its Q4 2024 revenues of $13.2 million, which it says is at the high end of its guidance of $10 million to $14 million.

However, lower product volumes ensured a 43.1% year-on-year (YoY) decline in its revenues. GAAP gross loss was 29.1% of the total revenue at $3.8 million, narrowing from -$4.3 million in the previous quarter (see FTC Solar Meets Q3 2024 Revenue Guidance; Offers Cautious Outlook For Q4).

GAAP net loss of $12.2 million narrowed from -$15.4 million in Q3 2024, but increased from a net loss of $11.2 million in Q4 2023.

FTC’s total contracted backlog stands at $502 million, compared to $513 million in Q3, largely comprising its 1P tracker product. The company is now taking orders for 100% domestic content trackers. These will be commercially available in Q3 2025. With several new wins from tier 1 companies, including a 5 GW supply arrangement with Recurrent Energy, a 330 MW award from GPG Energy, and a 280 MW award from Rosendin, FTC is strengthening its market positioning.

Philip Shen of ROTH opined, “The new CEO is leading his team well, highlighted by recent Tier 1 wins including Recurrent, Rosendin, and GPG Naturgy. We see potential for this momentum to sustain.”

Guidance

FTC continues to tread cautiously in its near-term projections. For Q1 2025, it guides its revenues to range within $18 million to $20 million. It expects revenue at the midpoint of this range to be up approximately 44% relative to Q4 2024.

Non-GAAP gross loss is expected to be between -$4.8 million and -$2.3 million, while non-GAAP gross margin is projected to range within -26.6% and -11.7%. Non-GAAP adjusted EBITDA will also be in the negative during Q1 2025, anywhere between -$13.3 million and -$10 million.

For FY 2025, FTC said it expects to achieve adjusted EBITDA breakeven on a quarterly basis.

“We believe our revenue bottomed in Q3, we saw growth in Q4, expect growth in Q1, and have been winning many new awards that we believe will help us ramp our revenue, achieve adjusted EBITDA breakeven, and become a strong and significant competitor in the industry,” said FTC Solar’s President and CEO Yann Brandt.