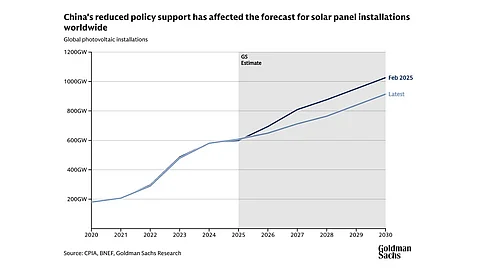

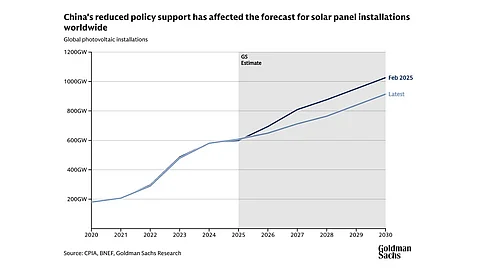

Goldman Sachs expects global solar installations to reach 914 GW by 2030, up 57% from 2024

China and the US are reducing policy support, creating market uncertainty for solar project developers, yet the future looks bright

Falling panel costs, free sunlight, and modular scalability are driving long-term solar power expansion, according to the analysts

Goldman Sachs Research forecasts a strong outlook for solar power, projecting global installations to reach 914 GW by 2030 – a 57% increase over 2024 levels – despite policy shifts in several major markets. This, however, is a reduction of more than 100 GW from the earlier estimate of 1,026 GW.

In China, the world’s largest solar PV market, a market-oriented framework for solar and wind projects took effect on June 1, 2025. The framework ended guaranteed grid access for all new large-scale commercial and industrial solar projects, along with minimum purchase price and grid volume commitments. This led to a rush in installations in the initial 5 months with close to 200 GW, but declining to 14.36 GW in June (see China’s June 2025 Solar PV Additions Fall To 14.36 GW).

Another large economy, the US, is also pulling back support under President Donald Trump’s administration. The passage of the One Big Beautiful Bill Act (OBBBA) has reduced tax credit support duration for clean energy projects, and the ensuing executive order from the US President to repeal green tax credits has created a lot of uncertainty in the market (see Trump Signs Executive Order To End Green Energy Subsidies).

Nonetheless, the Co-Head of Global Commodities Research at Goldman Sachs Research, Daan Struyven, does not see diminished policy support slowing down solar power development in the US since most projects benefit from the safe harbor provision to qualify for tax credits ahead of the mid-2026 deadline. However, he does warn that changes the federal government might make to these rules could hurt solar growth starting in 2028.

Another challenge that the analysts see is the demand-supply mismatch in solar energy generation. Sometimes solar power production exceeds demand, which leads to pushing wholesale power prices below zero, as is being seen in places like Australia and California. Excess solar and wind energy on the grid can imbalance power frequency, thus risking blackouts, as was seen in Spain and Portugal in April 2025.

Despite these trials, Goldman analysts believe that solar energy is still likely to meet a high share of global energy demand in the long run.

Solar power has seen the ‘fastest’ rise in the history of electricity generation, according to the analysts, as solar output has climbed to 2,129 TWh in just 11 years, supplying 8% of global power in the 12 months to July 2025, it explains. In comparison, wind took 19 years to reach 2,503 TWh and nuclear power 27 years to achieve 2,531 TWh.

Going forward, Goldman sees 3 ‘structural’ factors driving the growth of solar energy. Firstly, it is the declining cost of solar panels. Struyven estimates that prices fall by about 20% every time cumulative production doubles. This prompts more buying, which leads to more production and, thus, lower costs – a cycle that keeps repeating.

“The investment costs have fallen faster for panels than for any other investment good in modern history, including computers and communication equipment,” added Struyven.

Another reason solar is growing fast is that, once the panels are installed, making more electricity doesn’t cost anything extra. The only investment is the upfront cost of installing the panels and the ongoing cost of maintenance, since sunlight itself is free. There’s little chance of solar panel shortages because factories can make far more than needed – in 2024, China alone could produce 200% of the world’s demand.

Lastly, solar panels are modular, meaning they can be installed and expanded in small, affordable units. This makes it easier to spread power generation across many locations, vis-à-vis big coal or nuclear power plants that need to be built in huge, expensive chunks.

Struyven does add a caveat when he says, “Any slowing in solar growth is likely to come from reduced policy support and from power supply volatility rather than from solar panel supply bottlenecks,” says Struyven.

Speaking at the recent TaiyangNews Global Solar Market Developments 2025 Webinar, Rystad Energy VP Marius Bakke projected a steady growth for solar in the future, barring a dip in 2026 as various policy changes take effect (see Expect Record Solar Growth In 2025, But Near-Term Risks Loom).

TaiyangNews will also explore the US solar market in the view of regulatory shifts at the upcoming RE+ 2025 event in Las Vegas, US. It is co-organizing the 2025 Solar Made in USA summit in collaboration with RE+ and EUPD Research. To be held on September 8, 2025, it will feature leading names from the world of solar to discuss the future of US solar and storage manufacturing, and strategies for the players going forward under the regulatory hurdles created by the OBBBA. Registrations are open and can be done here.