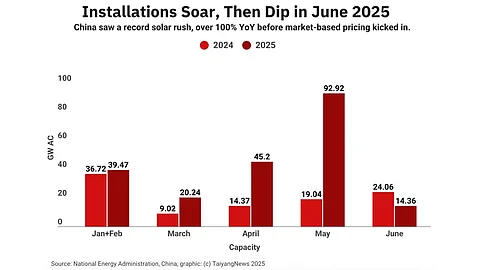

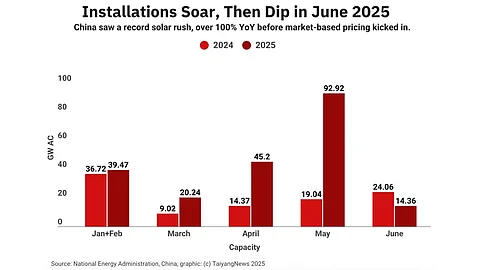

China’s solar additions dropped sharply to 14.36 GW in June 2025 after May's 92 GW rush

The country installed 197.85 GW from January to May this year as developers rushed to beat FiT expiry before June 1, 2025

With 212 GW installed in H1, 168 GW is still needed to hit the 380 GW annual forecast by the state

According to China’s National Energy Administration (NEA), solar PV installations plunged to 14.36 GW in June 2025, following a record-breaking 92 GW+ added in May. The sharp month-on-month (MoM) decline of over 84% was widely anticipated after the unprecedented surge before June.

The installation rush led to the NEA reporting 197.85 GW capacity additions within the initial 5 months of 2025. This was to avail a fixed price for electricity generation under the country’s feed-in-tariff (FiT) mechanism. Effective June 1, 2025, the world’s largest solar PV market transitioned to a market-based pricing mechanism, requiring all newly commissioned wind and solar power plants to sell electricity at market-determined rates, competing directly with fossil fuel-based generation.

It also led the country to surpass the 1 TW milestone for cumulative solar PV capacity (see China Solar Installations: From 100 MW In 2009 To 1 TW In 2025).

With the addition of 14.36 GW in June 2025, H1 additions totaled 212.21 GW, representing an annual increase of 109.7 GW in absolute terms or more than 107% year-on-year (see China Exceeds 100 GW Solar Installations Mark In H1 2024).

While the jury is still out on China’s actual H2 potential post the initial rush this year, this still leaves 168 GW to be achieved out of the 380 GW AC that the State Grid Energy Research Institute and National Climate Center project as the annual total for this year (see China Forecasts 380 GW New Solar PV Installations In 2025).

In a recent LinkedIn post Frank Haugwitz of AECEA said that China’s State Grid has lowered the annual projections for the country’s solar capacity additions to now 260 GW, or under 8 GW monthly additions till year-end. He, however, believes China can hit a minimum of 300 GW AC capacity to register approximately 10% annual growth.

He sees demand coming from several GW-scale projects in the pipeline which developers would want to realize anticipating lower tariffs under contracts for difference (CfD) regime. Additionally, he sees the government’s green power requirements for heavy industries as driving demand, as he shared during the recent TaiyangNews Global Solar Market Developments 2025 virtual conference (see Expect Record Solar Growth In 2025, But Near-Term Risks Loom).

As of the end of H1 2025, China’s cumulative installed solar PV capacity stands at 1.1 TW with a 54.2% annual increase. Wind power capacity additions of 51.4 GW during H1 2025 (including 5.1 GW in June) expand its total capacity to 570 GW.