IEA’s new report looks into manufacturing, trade and value of clean energy technologies globally

Solar PV, electric cars, wind turbines, batteries, electrolyzers, and heat pumps are the key technologies covered

China will continue to be the largest and cheapest solar PV module producer over the next few years

A new report from the International Energy Agency (IEA) estimates that the global market for key clean energy technologies – namely solar PV, wind turbines, electric cars, batteries, electrolyzers, heat pumps – will be worth over $2 trillion by 2035, up from $700 billion in 2023.

With this, trade in these technologies will rise sharply too, tripling to reach $575 billion within a decade, over 50% larger than the natural gas global trade today.

Solar PV capacity growth

According to the report, between 2021 and 2023, the global manufacturing capacity of solar PV modules increased from just over 450 GW to 1.2 TW. Announced expansion plans could expand this capacity to 1.6 TW by 2030.

Pointing to the scale at which the manufacturing expansion is taking place, the IEA analysts share that around 75 GW of PV module manufacturing capacity was added in 2020. In 2023, it jumped to 500 GW, well above the record levels of solar PV installations totaling around 425 GW. China alone added 430 GW of manufacturing capacity in this space.

Average utilization rates across PV module manufacturing facilities worldwide remained steady in 2023, at around 55%.

Clean energy technology manufacturing continues to expand with a project pipeline for solar PV as of June 2024-end of around 460 GW for modules, 280 GW for cells, 490 GW for polysilicon, and about 150 GW for wafers. By the end of 2024, the wafer manufacturing capacity is expected to reach 1.1 TW.

“Were all the planned solar PV capacity additions to take place, full chain capacity would jump from 850 GW at end-2023 (with polysilicon being the limiting component), to around 1 TW by end-2030 (with wafers being the limiting component). Module capacity would reach more than 1 600 GW, compared with just around 1,150 GW at end-2023,” according to the writers.

A majority of these planned investments are located in China. Put together, the existing manufacturing facilities, those under construction or committed, would be capable of producing over 7 TW of solar PV modules between 2024 and 2030. This will be almost 5 times more than has been installed globally by 2023-end.

Chinese influence in solar PV markets to grow

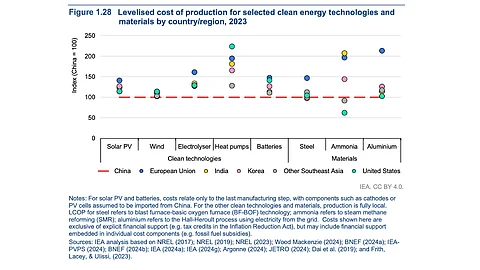

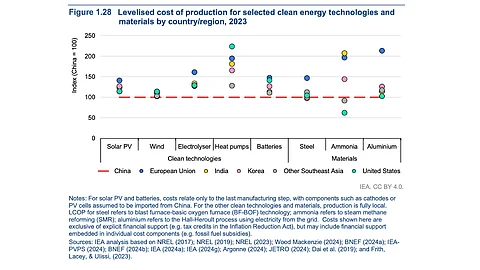

At present, China continues to be the world’s cheapest factory for the 6 major clean energy technologies considered in the Energy Technology Perspectives 2024 (ETP-2024) report. This does not factor in the financial support from the Chinese government.

Analysts estimate that it is up to 40% more costly on average to produce solar PV modules, wind turbines, and battery technologies in the US than in China, up to 45% more in the European Union (EU), and up to 25% more in India.

Currently, China accounts for around 70% of the global manufacturing share for all these 6 key technologies in terms of value with 80% of the world’s solar PV manufacturing capacity located here.

To explain the scale, the report writers point to the world’s largest 56 GW solar PV manufacturing facility under construction today in China’s Shanxi province. It can alone produce enough modules to cover virtually all EU demand today, according to the report that refers to the JinkoSolar fab (see Massive PV Manufacturing Complex In China).

The surge in Chinese manufacturing capacity has led to overcapacity, fierce competition among Chinese firms, and a slump in international prices. According to the report, if the recent import trend continues, PV module inventories could remain at 3 times the installations expected in 2024 in the EU and double those of the US by 2024-end.

China’s solar PV module manufacturing capacity is likely to remain well above the global demand over the next few years.

Going forward, the value of China’s clean technology exports is on track to exceed $340 billion in 2035 under current policies.

“As with EVs, the outlook for Chinese solar PV exports is very much dependent on policies to both drive the deployment of new capacity and develop new manufacturing capabilities in the rest of the world. Trade policies, including tariffs and NTMs to restrict imports, will be of particular importance, given the highly competitive nature of China’s solar PV industry,” reads the report.

Some of the other findings of the report include:

Global demand for solar PV modules outside China increases by over 250 GW over 2023-30 in the Announced Pledges Scenario (APS) with China capturing about 65 GW of this increase

Southeast Asia could become one of the world’s cheapest places to produce polysilicon and wafers for solar panels within the next 10 years as more countries in this region, along with those in Latin America and Africa, explore their clean energy economy.

Global demand for solar PV modules grows from 460 GW in 2023 to 675 GW in 2035 and 725 GW in 2050 as the market saturates

Chinese demand for modules in 2035 reaches around 415 GW in both APS and Stated Policies Scenario (STEPS)

By 2050, solar PV contributes half of the world’s nominal power generation capacity

India pivots from being a net importer of clean technologies today to a net exporter in 2035, if the clean energy transition accelerates

Beyond the mining and processing of critical minerals, emerging and developing economies could draw on their competitive advantages to move up the value chain

Well-designed industrial strategies will be crucial for clean energy transitions to continue gathering pace. For instance, a 100% tariff on solar PV modules today would cancel out the decline in technology costs seen over the past 5 years

Clean technology shipments will increase traffic through certain chokepoints like the Strait of Malacca which could risk supply chain resilience

Based on announced projects, geographic concentration in manufacturing is expected to persist to 2030, with China, the European Union and the United States accounting for over 80% of production capacity for the 6 clean technology supply chains

“This report shows that countries in Southeast Asia, Latin America, Africa and beyond and have strong potential to play important roles in the new energy economy. And it finds that with sound strategic partnerships, increased investment and greater efforts to bring down high financing costs, they can achieve this potential,” said IEA Executive Director Fatih Birol.

The complete report is available for free download on the IEA website.