InfoLink Consulting’s 2024 global solar PV demand projections range between 469 GW and 533 GW

China, the US, Europe and India will lead this growth even as they face their own challenges

Emerging markets show potential, but demand is likely to slow down from high growth to a more gradual increase after 2025

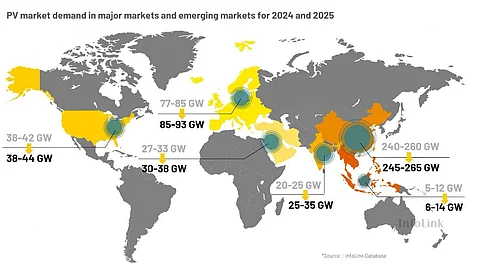

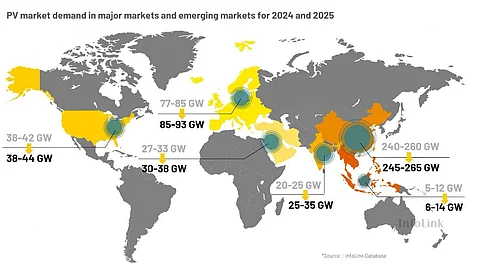

The growing clout of solar PV technology around the world is likely to create as much as 469 GW to 533 GW in 2024, according to InfoLink Consulting estimates, with China, the US, Europe and India driving this growth. It will be followed by up to 492 GW to 568 GW of global PV demand in 2025, representing a 5% to 7% annual growth.

Even though China will lead this global demand, analysts see installations settling between 240 GW and 260 GW this year as the country’s ground-mounted PV projects face various challenges including those related to grid infrastructure. Even for the distributed generation segment, rising land and rooftop leading costs also lower the investment returns. Some state-owned enterprises have withdrawn from this segment.

InfoLink does not expect the grid connection to ramp up until late 2024 and 2025. Hence, it pegs China’s 2025 solar PV demand at 245 GW to 265 GW.

High domestic supply costs are likely to lead to higher investment expenses for solar in Europe even as the European Union (EU) advances the Net Zero Industry Act (NZIA) and the Critical Raw Materials Act. The region will continue to rely on imports primarily from China.

Nevertheless, once the EU Forced Labor Regulation (EUFLR) comes into effect from H2 2027, Chinese companies may find themselves being embroiled in investigations related to labor practices.

Individual nations have their own internal challenges to overcome. For instance, leading European solar markets of Germany and Spain have been facing economic stagnation and project delays which, according to InfoLink, is dampening the overall regional demand. High financing cost, grid congestion and diminishing subsidies add their weight. Ample natural gas reserves in Europe may further dampen installation demand, it adds.

Due to these reasons, InfoLink forecasts between 77 GW and 85 GW of PV demand in Europe in 2024, which may rebound to 85 GW to 93 GW in 2025 with a 9% to 10% annual growth, but conditions apply (read economic performance and further policies).

The US market continues to face various geopolitical dynamics and trade issues, including the removal of Section 201 tariff exemption for bifacial modules, and Section 301 tariffs on imported cells and modules from China.

From 2025, Chinese polysilicon and wafers coming into the US will have a 50% tariff imposition. Due to this, Southeast Asia can become a supplier to the country but this will increase project costs. InfoLink analysts forecast 38 GW to 42 GW of PV demand in the US in 2024, to be followed by 38 GW to 44 GW in 2025.

Now that Donald Trump is back in the driver’s seat, everyone has been waiting with bated breath as to the new administration’s stance on the Inflation Reduction Act as well as the renewable energy industry in general even as solar companies see their stocks tumbling (see Fate Of US Solar PV Industry Under Donald Trump 2.0).

For India, InfoLink analysts project 20 GW to 25 GW of PV demand in 2024 and 25 GW to 35 GW in 2025. Demand here is primarily driven by government projects that are mostly scheduled to come online in 2026. The country’s current solar module production capacity can meet demand, but it depends on Chinese cells. Things should change for the local cell production industry as the Approved List of Models and Manufacturers (ALMM) List-II for solar cells comes into effect in 2026 (see India Invites Public Consultation On ALMM For Solar PV Cells).

Beyond these 4 top markets, demand is growing across newer markets. The Middle East is one example where thanks to Saudi Arabia, the UAE and Oman, utility-scale PV is growing with government support.

Even the Southeast Asian nations of Thailand, Malaysia and Vietnam are also driving up demand with favorable green energy policies. Yet, global demand will slow down from high growth to a more gradual increase after 2025.

“The global solar market faces a complex supply-demand landscape. With module prices nearing a low point and limited room for further drops, future growth will rely more on installation capacity and policy push,” state the analysts.