LONGi shipped 39.57 GW of solar modules in H1 2025, marking a 26% YoY increase despite challenges

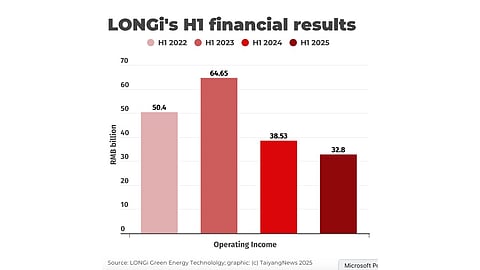

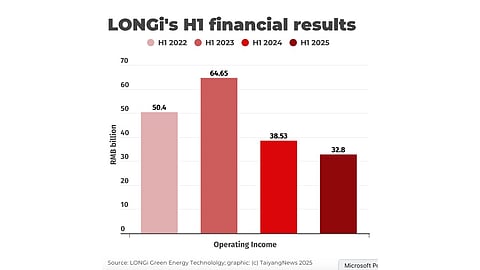

Overcapacity-driven price pressure resulted in a 14.83% revenue decline to RMB 32.8 billion and operating losses

Net loss narrowed to RMB 2.5 billion from RMB 5.24 billion in H1 2024, showing a partial recovery

LONGi Green Energy Technology, one of the world’s largest solar PV manufacturers, saw its solar module shipments grow by over 26% year-on-year (YoY) to 39.57 GW; however, it couldn’t remain immune to the industry challenges in H1 2025.

The manufacturer cited downward pressure on selling prices due to overcapacity challenges as the driver behind operating losses and a decline in revenues. The company's operating income declined by 14.83% YoY to RMB 32.8 billion ($4.6 billion).

LONGi also suffered a net loss of RMB 2.5 billion ($349 million), which narrowed from RMB 5.24 billion ($732 million) in H1 2024 (see LONGi’s H1 2024 Solar Module Shipments Totaled 31.34 GW).

Combined, solar cell and module shipments reached 41.85 GW during H1 2025, while silicon wafer shipments settled at 52.08 GW, including 24.72 GW sold externally.

In its H1 2025 results announcement, LONGi says its back contact (BC) technology gained strong market traction, with Hybrid Passivated Back Contact (HPBC) 2.0 capacity steadily. In H1, its shipments hit 4 GW across 70+ countries, including China, Europe, Asia Pacific, Latin America, and the Middle East. At the end of the reporting period, LONGi’s HPBC 2.0 solar cell production capacity reached 24 GW. By the end of 2025, the company expects HPBC 2.0 to exceed 60% of its total production capacity, completing a major product upgrade.

LONGi notes that US policy changes under the Trump administration, including AD/CVD measures on Southeast Asian nations and similar probes into suppliers from Laos, Indonesia, and India, along with reciprocal tariffs and weaker European demand from reduced subsidies and low power prices, will heighten uncertainty in global trade. These factors are expected to drive a shift toward emerging markets and reshape the global PV supply chain.

In a recent report, Ember noted that Chinese solar manufacturers are increasing their shipments to Africa, and not just to South Africa (see Africa’s Chinese Solar Module Imports Surge 60% In A Year).

In an exclusive interview with TaiyangNews Managing Director Michael Schmela, as part of the TaiyangNews SNEC Solar Leadership Conversations 2025 at SNEC 2025, LONGi Group’s Vice President Dennis She said that the company has built 50 GW annual production capacity for its BC technology (see SNEC 2025 Exclusive: Interview With LONGi Group VP Dennis She).