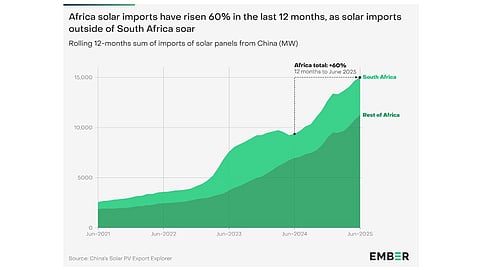

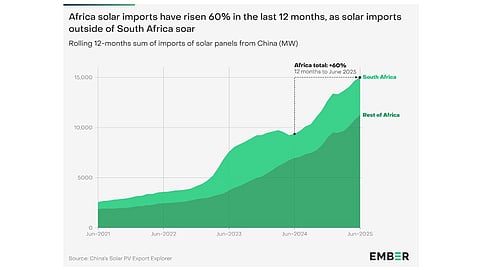

Africa’s solar imports from China surged 60% to exceed 15 GW in the last 12 months to June 2025, indicating rising demand, says Ember

Imports outside South Africa grew nearly 3x to 11.2 GW, signaling broader continental adoption of solar

Solar offers rapid payback, reducing diesel dependence, yet evidence is lacking for actual installation data

Africa is witnessing a sharp rise in solar adoption, with panel imports from China jumping 60% in the past 12 months to June 2025 to 15.03 GW, compared to 9.4 GW in the preceding 12 months, says Ember in its new research.

Although it acknowledges that the data does not confirm how much of this has actually been installed, Ember sees this as evidence that a ‘solar pick-up’ is happening at scale in several African countries, driven more by the distributed solar segment than by utility-scale.

South Africa was the largest importer, followed by Nigeria and Algeria during the reported duration, yet what comes out of Ember’s research is that much of the pick-up happened outside of South Africa.

The report offers data analyzed from Chinese customs to back up the claim. Solar panel imports outside of South Africa rose from 3.73 GW in 12 months to June 2023, to 11.2 GW in 12 months to June 2025.

Over the past year, 20 countries set new import records, while 25 countries imported at least 100 MW, up from 15 countries 12 months before, signaling a strong shift toward renewable energy across the continent. Algeria reported a 33-fold increase in solar panel imports over the previous 12 months, while Zambia rose 8-fold, Botswana 7-fold, and Sudan 6-fold. Liberia, Democratic Republic of Congo (DRC), Benin, Angola and Ethiopia, all more than tripled.

The rise in imports is not just a one-time spike, argues Ember in its new report titled The first evidence of a take-off in solar in Africa. Although December 2024 saw a record surge, imports have stayed high since then. What seemed like a year-end push by Chinese suppliers now appears to be a lasting structural trend, points out Lead Author of the report and Global Insights Programme Director at Ember, Dave Jones.

Ember analysts claim that solar panels imported into Sierra Leone alone would generate electricity equivalent to 61% of the total reported electricity generation in 2023, if installed. These panels would generate electricity equivalent to more than 5% of total reported electricity generation in 16 nations.

The Ember research shows rising solar panel imports could significantly cut fuel imports, with panels paying for themselves in months. In Nigeria, a $60 ($0.14/W) 420 W solar panel producing 550 kWh annually fares better than $60 of diesel that can generate only 275 kWh of electricity, and implies a payback time of just 6 months. In most major solar-importing nations, refined petroleum imports still outweigh solar imports by up to 107 times.

In Africa’s context, solar energy also acts as an enabler for economic growth through more reliable, cleaner and cheaper electricity access, adds the global energy think tank.

Ember does add a caveat in its report saying that the export data may not always reflect actual installations as solar panels may be re-exported to neighboring countries, delayed by 1 to 2 months during shipping, or stored for long periods before installation, meaning much of the reported capacity may not yet be installed or even in the country. It offers Europe’s example here as the continent had reportedly stocked 80 GW worth of modules in its warehouses, representing more than a year’s installations.

Currently, only South Africa and Egypt count their installed solar capacity in GWs, but going by the surge in imports, this could change. Ember adds, “This surge is still in its early days. Pakistan experienced an immense solar boom in the last two years, but Africa is not the next Pakistan – yet. However, change happens quickly. And the first evidence is now here.”

Meanwhile, some of the countries are taking steps towards establishing their own solar PV manufacturing capacity, but it remains limited for now, including in Morocco, South Africa, Egypt, and Nigeria. There are some bigger projects scheduled to come online in the next year, like EliTe Solar’s 3 GW project in September 2025, and Sunrev Solar’s 2 GW project in 2026 (see Middle East & Africa Solar PV News Snippets and China’s Sunrev Begins $200 Million Solar Manufacturing Venture In Egypt).

Japan’s TOYO recently launched initial production at its 2 GW solar cell factory in Ethiopia, which it plans to expand by another 2 GW (see TOYO Begins Production At 2 GW Solar Cell Factory in Ethiopia).

The complete Ember report is available for free viewing on its website.