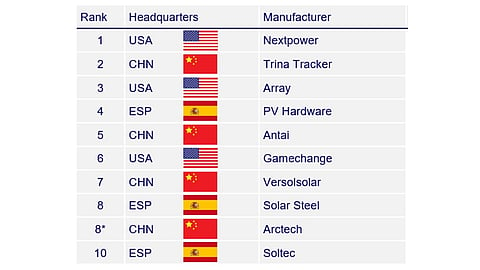

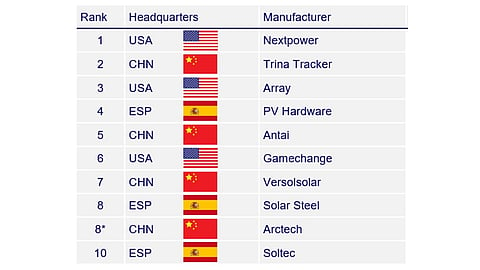

Nextpower ranked 1st in Wood Mackenzie’s global solar PV tracker manufacturer rankings based on H1 2025 data

The assessment covers 24 leading tracker suppliers across 5 countries and is based on weighted qualitative and operational criteria, not shipment volumes

TrinaTracker moved up to 2nd place, replacing China’s Arctech Solar, which dropped to 8th

Wood Mackenzie says 99% of global tracker shipments now come from Grade A manufacturers meeting industry best-practice benchmarks

Nextpower, the US-based solar tracker maker, continues its run at the top of Wood Mackenzie’s global solar PV tracker manufacturer rankings. Based on H1 2025 data, the market intelligence firm evaluates 24 leading manufacturers in the space across 5 countries.

Formerly known as Nextracker, Nextpower has been headlining Wood Mackenzie’s shipment rankings for 10 consecutive years through 2024. It had placed Nextpower at the top of the rankings in 2024, when it recorded a 39% year-on-year (YoY) increase in shipments, at 28.5 GW DC (see 2024 Global Solar Tracker Shipments Up 20% to 111 GW DC).

These rankings are based on 8 weighted criteria, explains Wood Mackenzie, and shipment volume is not one of them. These are ESG and CSR (30%), after-sales service and warranty (15%), research and development (15%), supply chain stability (15%), capacity utilization (10%), availability of 3rd party certifications (5%), financial conditions (5%), and manufacturing experience (5%).

Based on these criteria, China’s TrinaTracker has risen to the 2nd spot in the latest rankings for H1 2025, replacing its compatriot Arctech Solar (2024) that slipped to the 8th position, sharing the place with Spain’s Solar Steel. Among other Chinese suppliers, Antai is placed 5th and Versolsolar 7th.

US-based Array and GameChange Solar stand at 3rd and 6th, respectively, while Spain’s PV Hardware and Soltec are among the top 10 on 4th and 10th positions, respectively.

Analysts highlight that adherence to industry best practices is now the main differentiator. Out of the top 10, 6 companies have achieved an EcoVadis Bronze rating or higher, placing them in the top 30% of companies globally for sustainability. Top-ranked manufacturers have also established rigorous after-sales and warranty standards to reduce long-term risks for asset owners.

Wood Mackenzie says it awards Grade A to manufacturers that meet its benchmark for industry best practice by meeting at least 5 of the above-mentioned criteria. It claims 99% of global tracker shipments now come from Grade A manufacturers.

“The Grade A designation serves as a market signal, highlighting suppliers that combine operational robustness with practices aligned to global procurement standards,” added Wood Mackenzie’s Senior Research Analyst, Timothy Shen.

“Increasingly, competitive advantage is defined not just by shipment volume, but by capabilities across pioneering Environmental, Social, and Governance (ESG) initiatives, service quality, and resilient supply chains,” added Shen.

Leading manufacturers are also leveraging regionalized assembly, noted the analysts, as it helps them navigate steel price volatility, logistics disruptions, and trade policy-related uncertainties. Chinese OEMs especially use this route to strengthen access to North America, Europe, and emerging markets.

Another observation is that the top 10 manufacturers in the list have invested in AI-integrated control systems or high-strength materials.