German chemical producer Wacker Chemie expects its 2023 group sales to decline by 22% annually, primarily due to the polysilicon business division not doing so well last year, as per the company's preliminary financials.

All of its chemical segments saw a persistently weak market environment, with the decline 'particularly pronounced' in the polysilicon business.

Wacker expects to report polysilicon sales of €1.60 billion this year, down from €2.29 billion in 2022.

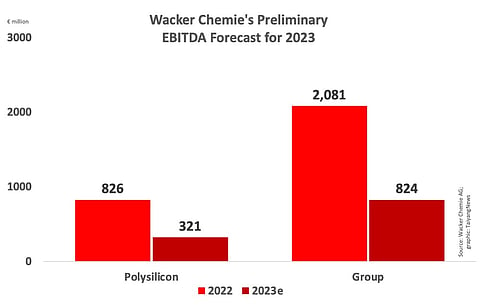

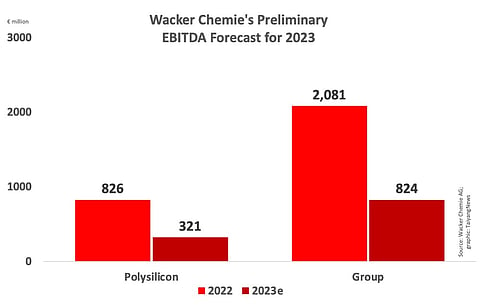

Polysilicon was the business segment with the largest annual drop in EBITDA even though the company reported EBITDA declines across all business segments. While the final audited results will be published on March 12, 2024, Wacker says its polysilicon division's EBITDA fell 61% to €321 million, compared to €826 million in the previous year.

The management explained, "This decline was primarily prompted – for production-related reasons – by lower volumes and prices for solar-grade polysilicon. Ongoing high energy prices in Germany also had a negative impact."

Overall, Wacker's total group sales are expected to settle at €6.4 billion, down from €8.21 billion in the previous year. Group EBITDA is feared to have gone down 60% annually to €824 million. Wacker expects net income to be down 74%, to €330 million.

"The global industrial engine began to stutter in 2023 and many companies felt the impact, as did we at WACKER," said President and CEO Christian Hartel. "Price pressure was high, and the recovery in customer demand that was hoped for at the beginning of the year did not materialize. Persistently high energy prices in Germany further impacted our business."

Even though Hartel does not see a recovery in demand anytime soon, he is hopeful of things getting better in the long term. "As great as the current challenges may be, we will continue to benefit from global megatrends in the medium and long term. Digitalization, renewable energies, electromobility, and energy conservation are among the key drivers of our business," added Hartel.

Anticipating polysilicon oversupply in 2024 as more capacity comes online, Bernreuter Research recently warned of fierce cut-throat competition. It does keep Wacker and other non-Chinese companies out of this impact thanks to the US creating a higher-price market for such players with its Uyghur Forced Labor Prevention Act (UFLPA) (see Fierce Cut-Throat Competition In Polysilicon, In 2024).