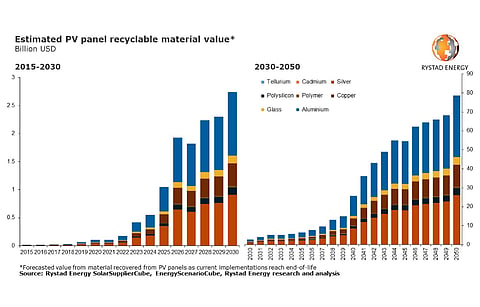

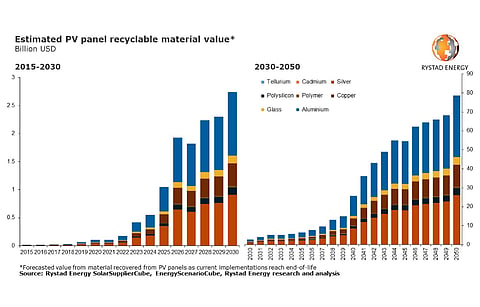

As solar PV waste is estimated to balloon to 27 million tons a year by 2040, Rystad Energy believes it could be a market worth over $2.7 billion in 2030 and grow to $80 billion by 2050, up from $170 million in 2022, thanks to proliferation of the utility scale solar segment.

Currently, however, their resale value is not enough to compensate for the transportation, sorting and processing costs, hence at the end of their working life solar panels are generally dumped into landfills. Nonetheless, as demand for solar grows so will the requirement to have minerals which may not be easy to procure with supply bottlenecks.

In such a situation, the analysts believe recycling can come in as a relief and by 2040, these can make up 6% of solar PV investments, up from 0.08% now.

Mostly it is aluminum, silver, copper and polysilicon with high value that need to be extracted. The greatest volume of material is glass that has a high recycling rate but relatively low resale value, and silver on the other hand makes up only 0.05% of the total panel weight but makes up 14% of the material value.

By 2035, Rystad Energy estimates solar energy capacity additions to peak at 1.4 TW under its 1.6°C scenario. "By that time, the PV recycling industry can supply 8% of the polysilicon, 11% of the aluminum, 2% of the copper, and 21% of the silver needed by recycling PV panels installed in 2020 to meet the demand for materials. This recovery potential can ease strains on the mining sector and reduce the solar PV panels' carbon footprint," explain the analysts.

A supportive policy framework is significant to create a market to match technological advancements taking place in the space with the emergence of startups like NPC of Japan and SolarCycle of the US (see SolarCycle Raises $6.6 Million In Growth Funding).

"Rising energy costs, improved recycling technology, and government regulations may pave the way for a market where more defunct solar panels are sent to recycling rather than the nearest landfill. Recycling PV panels can help operators save costs, overcome supply chain woes and increase the likelihood of countries meeting their solar capacity goals," said Rystad Energy analyst Kristin Stuge.

Recently, the International Energy Agency (IEA) in a special report on solar supply chains stated that supplies from recycled materials can meet over 20% of the solar PV industry's demand for aluminum, copper, glass, silicon and almost 70% of silver between 2040 and 2050 (see IEA Calls For Diversified Solar Supply Chains).