Solar module prices increased in January 2026, but manufacturers are signaling steeper increases ahead, especially from April, says pvXchange

China’s decision to remove solar export tax rebates from April 1, 2026, and the increase in raw material prices are cited as likely reasons for this surge

Distributors are apparently warning customers of imminent price hikes and encouraging inventory stockpiling

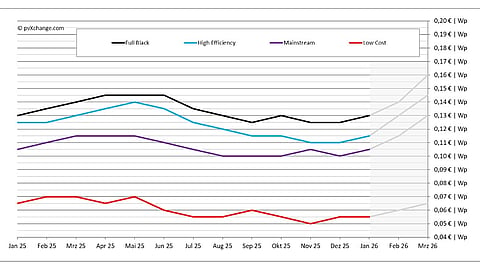

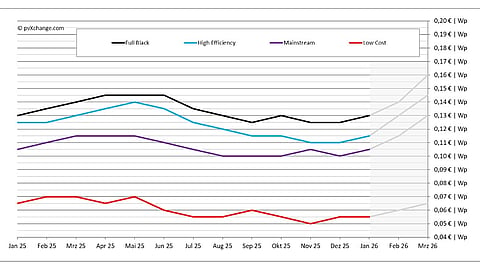

After a deep lull in the market and a quiet end to 2025, solar module prices saw a steep increase in the early days of January 2026, which pvXchange attributes to China’s decision to eliminate export tax rebates from April 1, 2026 (see China To Remove Solar Export Tax Rebates From April 1, 2026).

While prices rose only slightly, from 0% to 5% on average across technologies in January, recent manufacturer announcements suggest much sharper increases may be coming in the next few months.

TaiyangNews PV Price Index is also noticing price increase for cells and modules since the beginning of the year (see TaiyangNews PV Price Index: CW3 2026).

Martin Schachinger of pvXchange says that several distributors have started informing their customers to expect price increases in early April and to stock up their inventories.

“Yet when customers try to secure supplies for the second quarter, they often encounter prices far higher than the 9% increase that would be justified by changes in China alone. In the project sector, price increases of up to 20% are now expected, while in distribution and online stores, module prices in some cases have already risen by as much as 30% in recent days,” he shares.

Increases in raw material prices, including silicon ingots, silver pastes, cells, glass, and aluminum for module frames, also contribute to this rise. However, Schachinger believes that this does not justify prices going up by 20% to 30%, especially when production costs haven’t gone up as much.

Chinese manufacturers are currently running their facilities at full capacity to be able to ship as much stock as possible until March 2026, after which production lines will likely be scaled back to reduce costs.

Many producers are willing to take advantage of increased prices after the government’s announcement to try to restore profits and recover losses from recent low-price years. This pattern has been observed before: prices are often pushed up too much, demand then weakens, and prices usually fall back again soon, notes Schachinger.

Calling such trends unsustainable and ignoring buyers, pvXchange points out that in Europe, small solar installations are declining, while developers and installers are shifting toward larger commercial and utility-scale projects – a trend likely to continue in 2026. These projects are sensitive to price changes, so sharp price increases could hurt their profits and delay or cancel projects.

Schachinger recommends that the German market brace itself by cutting red tape to prevent delays in grid approvals and permits from stalling projects. If a small EEG feed-in tariff remains as a backup and tender prices stay reasonable, the transition could still support a strong solar outlook this year rather than a shift back to fossil fuels.