Risen Energy has delayed its new solar cell and module production factory plans

It cites disruption in the supply chain industry that impacts material and equipment procurement

Risen’s revenues in H1 2024 suffered a decline due to low prices as it posted a net loss of over RMB -962 million

Risen Energy, a Chinese solar PV manufacturer, has delayed its new solar cell and module manufacturing projects citing disruptions in the overall industry supply chain and external environment impacting its ability to procure materials and equipment for these projects.

The delayed projects are a 5 GW n-type low-carbon high-efficiency heterojunction (HJT) cell and a 10 GW high-efficiency solar module project. The decision also impacts Risen’s upcoming Global High-Efficiency Photovoltaic R&D Center project.

In 2022, it had initially raised RMB 4.97 billion ($693 million) for the above projects through a private A-share offering.

In a stock exchange announcement on August 26, 2024, the company assured that the project construction progress is ‘moderately delayed’ and that the investment content, total investment amount, and implementation plan of the fundraising project are unchanged.

The production timelines for the 5 GW cell and 10 GW module projects have been pushed from June 2024 to March 2025. The R&D Center is now targeted to come online in December 2025, adjusted from its June 2025 deadline earlier.

Meanwhile, Risen declared its H1 2024 financial results according to which it shipped 7.92 GW of solar modules during the period. While China was the largest procurer of its modules with 4.05 GW capacity, the US and Spain followed next with 479.72 MW and 440.3 MW, respectively.

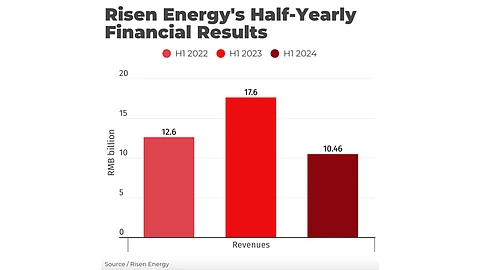

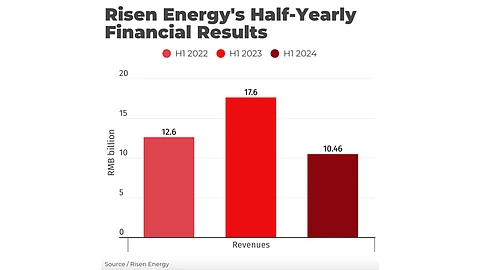

Its revenues of RMB 10.46 billion ($1.47 billion) in the 1st half of 2024 represented a 40.59% year-over-year (YoY) decline, attributed to a drop in prices for PV products during the period (see China’s Risen Energy Scores Well In H1/2023). The net loss of RMB -962.75 million ($-135 million) was a YoY drop of 211.8%.

At the end of June 2024, Risen’s annual solar module production capacity reached 35 GW. Within H2 2024, it targets to expand the same by adding a 15 GW high-efficiency n-type low-carbon HJT cell and module manufacturing facility in Ninghai City of Zhejiang Province, a 4 GW solar cell and 6 GW module plant in Jintan City of Jiangsu Province, and a 10 GW solar cell plant in Chuzhou City of Anhui province.

At the recently concluded SNEC 2024 in Shanghai, China, Risen Energy showcased its HJT product line to TaiyangNews (see Risen Energy Showcases HJT Product Line At SNEC 2024).