The solar module capacity of the Middle East and Africa region is projected to grow from 3.4 GW to 62.12 GW by 2030, according to Sinovoltaics

The region aims for full vertical integration with 45 GW polysilicon and 290,000 tons MGS capacity, mostly led by the Chinese

Strategic location positions MEA to rival Southeast Asia as a key solar export hub by 2030

Despite reliance on Chinese investors, government support and local content rules drive significant manufacturing growth

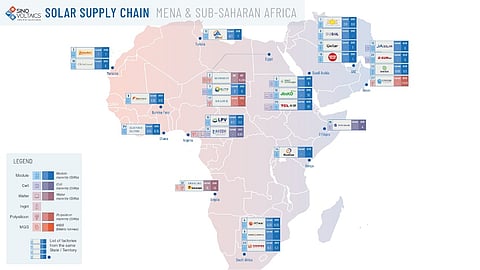

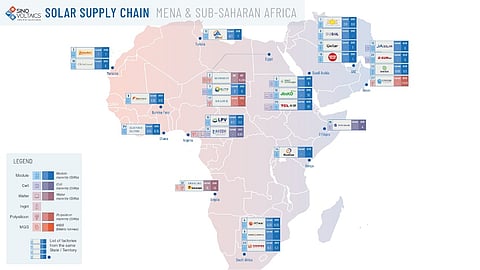

Sinovoltaics’ inaugural mapping report forecasts the Middle East and Africa (MEA) to reach 62.12 GW module capacity by 2030, up from 3.4 GW today, signaling the region could fast-become a global supply hub.

At present, the region has 2.5 GW of solar cell and 8.05 GW of ingot production capacity. By 2030, the report maps the MEA to host 52.55 GW of solar cell, 45 GW of polysilicon, and 290,000 tons of metallurgical-grade silicon capacity.

“This manufacturing expansion is designed to close supply gaps in regional markets and North America, where limited upstream solar component production and low tariffs create strong demand,” states Sinovoltaics in its report that lists 27 factory sites based on publicly announced projects.

Unlike Europe, India, and North America, which are yet to have the local supply of polysilicon, wafers, and cells, the MEA region seems to have learnt the lesson as its baby steps into solar PV manufacturing are already big, with full vertical integration.

Its proximity to Europe and Sub-Saharan Africa markets will hold it in good stead as it can potentially replace Southeast Asia as an exporter of solar modules to these regions, for which it recently mapped 101 GW module capacity by 2030 (see Sinovoltaics Predicts 101 GW SE Asia Solar Module Capacity By 2030).

Even the US could be a possible destination if the US tariffs remain at 10%, but the 30% tariff on South Africa may prove a challenge, warn the analysts.

“Though these developments could help in reducing the dependence on foreign suppliers, the lion's share of the manufacturing capacity would be Chinese. Nonetheless, the investments and goals are fantastic as it will create jobs, and help the region in its clean energy transition while divesting from fossil fuel alternatives,” according to Sinovoltaics.

Government support and local content requirements are largely responsible for the planned manufacturing growth, according to the analysts. Yet challenges remain, ranging from grid infrastructure to supply chain disruptions.

The MENA and Sub-Saharan Africa Solar Supply Chain Map of Sinovoltaics is available for free download on its website.