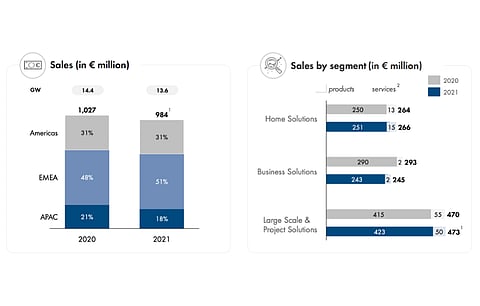

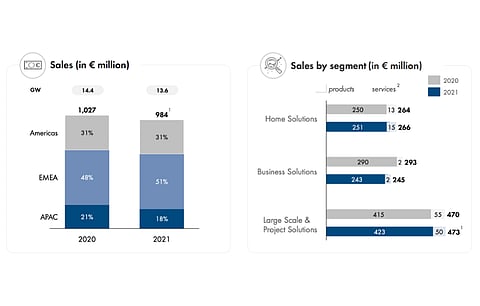

German solar PV inverter supplier SMA Solar Technology AG saw its annual sales for 2021 drop by 4% to €983.7 million, owing to the COVID-19 pandemic and shortage of electronics chips supply. It sees the shortage continuing in the coming months, but claims order intake remains healthy.

SMA's suppliers are based out of the US with their goods produced in China due to which the suppliers give preference to customers in these geographies, explained the company's CEO Jürgen Reinert which worsened in H2/2021. Compared to 14.4 GW inverter output sold in 2020, SMA shipped 13.6 GW last year.

Its EBITDA also fell down to €8.7 million—lower than its 3rd revised guidance of €9.0 million it offered in March 2022 which was due to the termination of a long-term operations and maintenance (O&M) contract (see SMA Solar's 2021 Preliminary Financial Results).

Going forward, while the management does not see any threat to its guidance due to the ongoing war in Ukraine at present while adding that 'a conclusive assessment is currently not possible'. It does remain cautious for the business ahead expecting chip shortage to continue in 2022. Sales guidance for 2022 has been reiterated as between €900 million to €1,050 million and EBITDA as €10 million and €60 million.

In Q1/2022, it guides for sales to range between €210 million to €220 million, lower than €240.4 million it reported for Q1/2021. EBITDA for the 1st quarter of 2022 is forecast as €12 million to €16 million, down from €20.1 million a year back.

The German supplier counts its growth in 2022 with a large order backlog that increased to €886.6 million as on December 31, 2021, having increased by more than 20% annually. By March 30, 2022 it increased further to €1,045 million, led by products business.

"We expect the shortage of electronic components to continue in the coming months. However, we will continue to do all we can to also satisfy our order intake, which remains very healthy. In the medium to long term, we see outstanding growth potential for SMA," added Reinert.