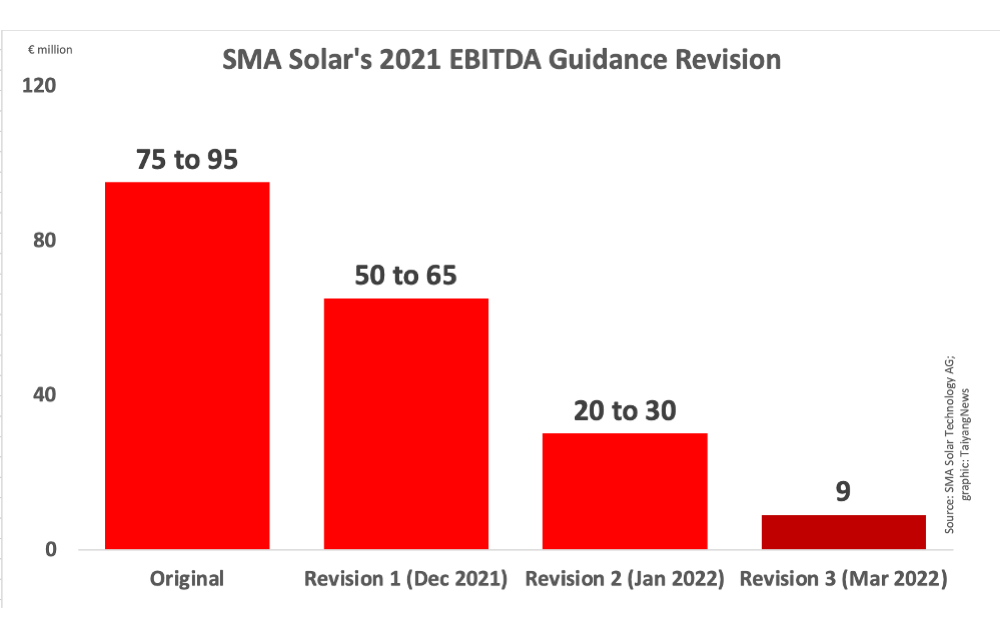

- SMA Solar has offered a revised guidance for EBITDA in 2021, now expecting it to be around €9 million

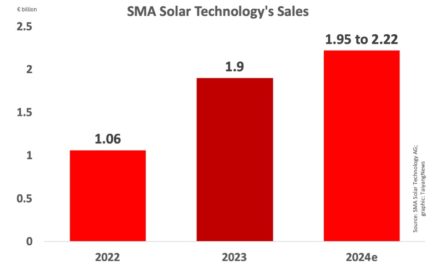

- For 2022, it expects EBITDA to be between €10 million and €60 million, and sales in the range of €900 million and €1,050 million

- Management cites continuing chip supply challenges for the cautious guidance for this year

Solar inverter supplier from Germany, SMA Solar Technology AG has lowered its EBITDA guidance for 2021 the 3rd time since December 2021, down to about €9 million, from the previous guidance of €20 million to €30 million it offered in January 2022 (see SMA Solar Lowers 2021 Earnings Guidance).

The management said the preliminary result is still subject to the auditor’s review.

The lowered guidance is a result of the company’s previously disclosed extraordinary dissolution of an operations and maintenance (O&M) contract for PV power plants. It counts its sales for 2021 amounting to €984 million. Final results will be declared on March 31, 2022.

It has also offered the guidance for 2022 for sales between €900 million and €1,050 million, and EBITDA of between €10 million and €60 million, citing the continuing shortage of chips globally.

“The supply situation remains tight and will continue to present us with challenges as the year progresses. We will do everything in our power to service the currently very good order intake,” said SMA CEO Jürgen Reinert. “After overcoming the component shortage, we see excellent growth prospects for SMA, especially against the background of the intensified global efforts to curb the climate crisis.”

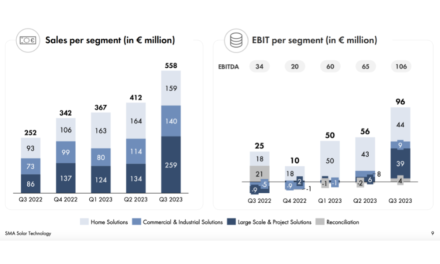

US investment bank Cowen’s analyst Jeffrey Osborne opined that the chip supply issue is likely more impactful to the higher margin residential and commercial segments since the company has not shared which solar segment it hurts the most. “We note that SMA is exposed to the utility scale sector, which has also faced project delays due to panel availability challenges, inflation on key materials and shifts in policy,” he added.

Nonetheless, SMA’s US competitor Enphase Energy, a micro inverter company, fared rather well growing its 2021 revenues to $1.38 billion, up from $774.4 million in 2020, having managed the supply chain issues with growing demand (see Enphase Ships 1.1 GW In Q4/2021). Another solar inverter manufacturer, SolarEdge from Israel exited 2021 with 34.6% growth in revenues and 21% net income improvement (see SolarEdge’s Q4/2021 Financial Results).