Solar module prices dropped by up to 8% in mid-July 2025, nearing the unhealthy levels of early 2025

Oversupply and weak demand prompted wholesalers to lower module prices

Polysilicon price decline and weak Chinese demand are also driving cheaper modules into the global markets

After a brief period of stability, solar module prices are starting to fall once more, declining 5% to 8% across all technologies as of mid-July 2025, according to pvXchange. It sees prices moving back strongly toward the ‘unhealthy’ levels seen at the beginning of the year.

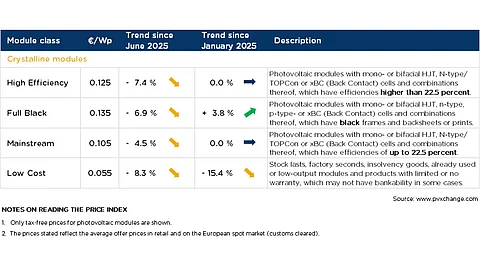

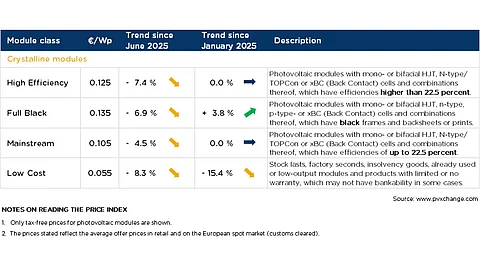

As of July 9, 2025, prices for crystalline silicon solar PV modules with an efficiency of over 22.5% dropped by 7.4% since June 2025 to €0.125/W. Over the same period, there was a decline of 4.5% for full-black modules, while mainstream panels with up to 22.5% efficiency saw their prices drop by 4.5% to €0.105/W.

It attributes the decline to some important wholesalers lowering module prices by a maximum of around €0.01 to €0.02/W due to a lack of demand after months of ‘cautious price increases’. Others may follow suit soon as they built inventories, expecting demand.

Moreover, falling polysilicon prices in China and the drop in domestic demand following the rush to install before the June 1, 2025 deadline in the world’s biggest market, means modules are once again available at lower prices in the global market, observes pvXchange. It cautions that this could become a longer-term trend.

Martin Schachinger, Managing Director of pvXchange, says that bifacial glass-glass modules for large ground-mounted systems being delivered to European construction sites are priced well below €0.10/W.

This is troubling news for module manufacturers, many of whom have not turned a profit in the past 2 years, he points out. Several manufacturers may not be able to survive this prolonged slump, especially those in China, where the government is pulling back state support while their access to low-interest loans is either being reduced or canceled.

The Chinese government is nudging the industry towards voluntary price floors and production caps to ease competition and stop the price war. However, Schachinger points out that such measures have rarely worked. In the end, every company keeps pushing out all it can into the market, irrespective of the price.

pvXchange sees overproduction levels persisting for the near future, especially if global demand drops due to political tensions and a potential shift toward fossil fuels. It points to the situation in the US market, where anti-renewables sentiment is strong at the regulatory level. Finding equally profitable alternatives, like the US, is tough, it adds.

As for Europe, Schachinger does not see the market recovering anytime soon, at least not in H2 2025, both in terms of demand and supply. Within the EU, some markets send conflicting signals, while others are hostile to solar and wind. Efforts to reduce bureaucracy and to expand transmission and grid infrastructure remain weak. This political climate is undermining investor confidence in the energy sector.

“Even in the European Commission, which has generally favoured science-based targets, the general shift to the political right is creating an environment in which it is difficult to imagine a consistent pursuit of set climate targets,” according to pvXchange.

According to the TaiyangNews PV Price Index 2025 for Calendar Week 29, most upstream products saw double-digit increases, apparently as a result of the MIIT calling for curbing ‘disorderly and low-price competition’ (see TaiyangNews PV Price Index—2025—CW29).