US residential solar and storage installer, and financier Sunrun met its solar installation guidance for Q4/2023 with over 227 MW installed while exceeding storage deployment guidance, representing 154% annual growth. While it was in the red during the quarter, the management is confident of 'very robust sequential growth' into Q2 and beyond.

Sunrun reported a net loss of -$350.1 million during the quarter, while total revenue was down 15% year-on-year (YoY) to $516.6 million. Even though customer agreements and incentives revenue increased 33% annually to $79.3 million, solar energy systems and product sales dropped by 47% to $195 million.

For the year 2023, Sunrun's total revenue declined 3% to $2.26 billion, divided between $1.18 billion in customer agreements and incentives, and $1.07 billion in solar energy systems and product sales.

Net loss during the year was -$1.6 billion. Excluding the $58.6 million non-cash charge related to its equity investment in Lunar Energy in Q4, the company said its net loss would have been -$387.8 million.

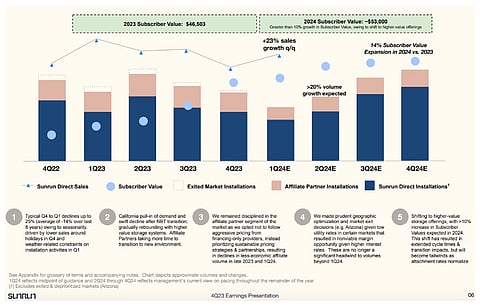

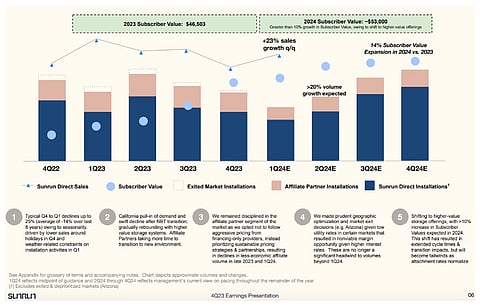

On the upside, Sunrun's net subscriber value increased significantly to $13,445 during Q4/2023 as it added 30,005 new customers including 27,000 subscriber additions. Customer count went up by 17% annually. Annual recurring revenue from subscribers was over $1.3 billion as of December 31, 2023.

The management said, "Additionally, hardware costs for key items such as modules, inverters and batteries continue to fall based on current procurement activities, and are expected to provide additional benefits of $1,046 in future periods to Net Subscriber Value. While these cost tailwinds do not benefit Q4 deployments, we have provided the impact of the cost benefits we expect to achieve in future periods as we work through higher-cost inventory."

Philip Shen of ROTH MKM sees Sunrun financials as healthy. He said, "Q4 NSV of ~$13k was strong with a healthy 2024 outlook; ITC adders continue to be a source of upside in 2024; the 2024 storage guidance was strong; management increased capacity and/or extended maturities across the board (revolver, warehouse, and working on convert); and the cash generation outlook of $200-500mn remains intact."

Sunrun also declared a new partnership with home improvement retailer Lowe's Companies. This collaboration will provide households with solar and storage services inside hundreds of Lowe's stores in the US.

Just before the results announcement, Sunrun said it plans to offer $475 million in convertible senior notes due 2030 in a private placement to institutional buyers, with an option to purchase an additional $75 million.

It plans to use the net proceeds to repurchase a portion of its 0% convertible senior notes due 2026, to pay the cost of the capped call transactions, and to repay outstanding debt and other general corporate purposes.

During Q1/2024, Sunrun expects to install between 165 MW to 175 MW new solar capacity, representing a decline of almost 25% from Q4 at the midpoint. It cites seasonality driven by lower sales around holidays in Q4 and weather-related constraints for installations for this subdued forecast.

For the full year, solar installations are expected to be in the range of down 5% to up 5%, based on its subscription offering and strong results expected from its 'disciplined go-to-market approach.'

For storage, however, it sees great promise, expecting 125% to 139% annual growth with installations within the range of 160 MW to 170 MW during Q1/2024. During 2024, storage capacity additions will range within 800 MWh to 1 GWh, reflecting 40% to 75% annual improvement.

The management also forecasts its subscriber values to increase by over 10% this year riding on the mix of higher-value offerings and input cost decline. It targets for a growth of more than 15% in total value generated.