In Q2 2025, Sunrun’s revenue rose 9% YoY to $569.3 million, driven by strong storage demand and subscription growth

Storage installations and attachment rates increased sharply, with 70% of new customers opting for storage solutions

The company achieved record-high contracted net value creation, doubling from last quarter, and raised its full-year guidance

In Q2 2025, Sunrun’s revenue rose 9% YoY to $569.3 million, fueled by a 15% increase in subscribers and a 48% jump in storage demand. The company is swiftly accelerating its storage-first strategy as the residential solar market faces pressure from the One Big Beautiful Bill Act (OBBBA).

Sunrun’s customer agreements and incentives business contributed $458 million to total revenues during the quarter, representing an annual increase of 18%. At $113 million, the solar energy systems and product sales segment brought in 18% less revenue.

The company's solar installations rose to 227.2 MW compared to 192.3 MW in Q2 2024, comprising 157.7 MW installed with storage. Vanilla storage capacity installations totaled 391.5 MW.

During the reporting quarter, Sunrun’s customer additions with storage went up by 50% YoY while storage attachment rates reached 70%. According to the company, it is predominantly using US-manufactured equipment, thus not greatly impacted by the Foreign Entity of Concern (FEOC) provisions.

Sunrun foresees installation demand shifting before the 25D ITC expires in 2025, but expects stronger 2026 growth from its subscription model and storage-first strategy.

“The investment tax credit for customers who purchase solar outright or finance it with a loan, known as 25D, will sunset at the end of 2025. Sunrun, however, primarily benefits from the commercial investment tax credit, known as 48E, as 94% of new customer additions are subscribers,” explained Sunrun CEO Mary Powell. “The 48E credit ends starting in 2028 for the solar portion of a project, but remains in place for storage through 2033.”

The company expects the solar tax credit to drop in 2028, but is securing eligibility for full credits through 2030, having started construction activities on projects before the July 2026 deadline.

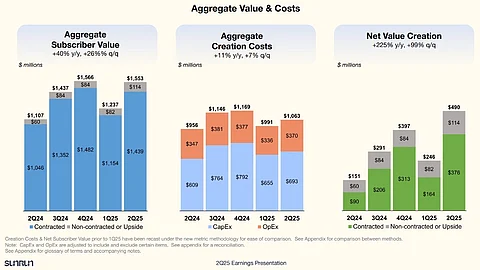

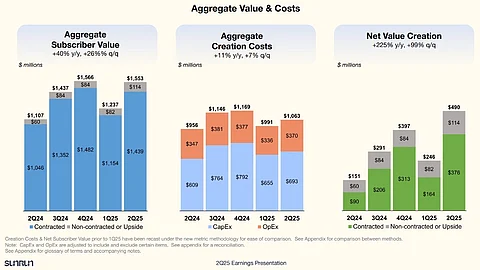

Sunrun exceeded its aggregate subscriber value guidance as it grew by 40% YoY to generate $1.6 billion. Its contracted net value creation of $376 million was the company’s highest ever, as it more than doubled from the previous quarter, also exceeding guidance.

Philip Shen of ROTH opined, “The company, in our view, is in a strong position with the ITC for leasing not denied through 2027. Additionally, management shared that it has safe harbored enough volume through 2030. The key risk to watch out for is whether retroactivity is in the Trump EO expected on 8/18.”

Guidance

For Q3 2025, Sunrun projects $1.5 billion to $1.6 billion in aggregate subscriber value with an 8% YoY growth at midpoint. Its contracted net value creation guidance of between $275 million and $375 million represents a 58% growth at the midpoint. The company remains positive about cash generation, expecting to report the 6th consecutive quarter of positive cash generation within $50 million to $100 million, after reporting $27 million for this category in Q2.

For the full year 2025, Sunrun’s aggregate subscriber value guidance remains unchanged at $5.7 billion to $6.0 billion, as does cash generation at $200 million to $500 million.

Sunrun has, however, increased the contracted net value creation guidance from $650 million to $850 million previously, to between $1.0 billion and $1.3 billion for the year, representing a 67% jump annually.

TaiyangNews will explore the US solar market in view of the regulatory shifts at the upcoming RE+ 2025 event in Las Vegas, US. It is co-organizing the 2025 Solar Made in USA summit in collaboration with RE+ and EUPD Research. To be held on September 8, 2025, it will feature leading names from the world of solar to discuss the future of US solar and storage manufacturing and future strategies for the players in light of the regulatory hurdles created by the OBBBA. Registrations are open and can be done here.