- Sunrun grew its annual revenues in 2021 by 75% to $1.6 billion with 31% growth in installations

- In Q4/2021, its revenues were $435 million and installed 220 MW new solar energy capacity

- For Q1/2022, it has guided for installations to range between 195 MW to 200 MW and 20% growth in annual installations

US residential solar power company Sunrun Inc had a strong year in 2021 as it added more than 110,000 customers, reporting a growth of 31% in installations and 75% improvement in annual revenues with $1.6 billion, yet its net loss attributable to common stockholders was $79.4 million.

Management admitted to experiencing negative impacts of Omicron in terms of fulfilling customer orders due to limited labor productivity which led to increase in prices.

“Additionally, the inflationary pressures seen across the economy are increasing traditional power rates in many areas, providing us more headroom to increase our prices as well, while still delivering a strong customer value proposition,” shared Sunrun CFO Tom vonReichbauer. “We are entering 2022 with a record backlog of orders and are working hard to install systems for our customers as quickly as possible.”

Sunrun is buoyed by its prospects in 2022 as it has guided for solar energy capacity installed growth for the group to be at least 20% or more. It has guided for total value generated to grow faster than solar energy capacity installed during the year. For Q1/2022, it has guided for the installations within the range of 195 MW to 200 MW.

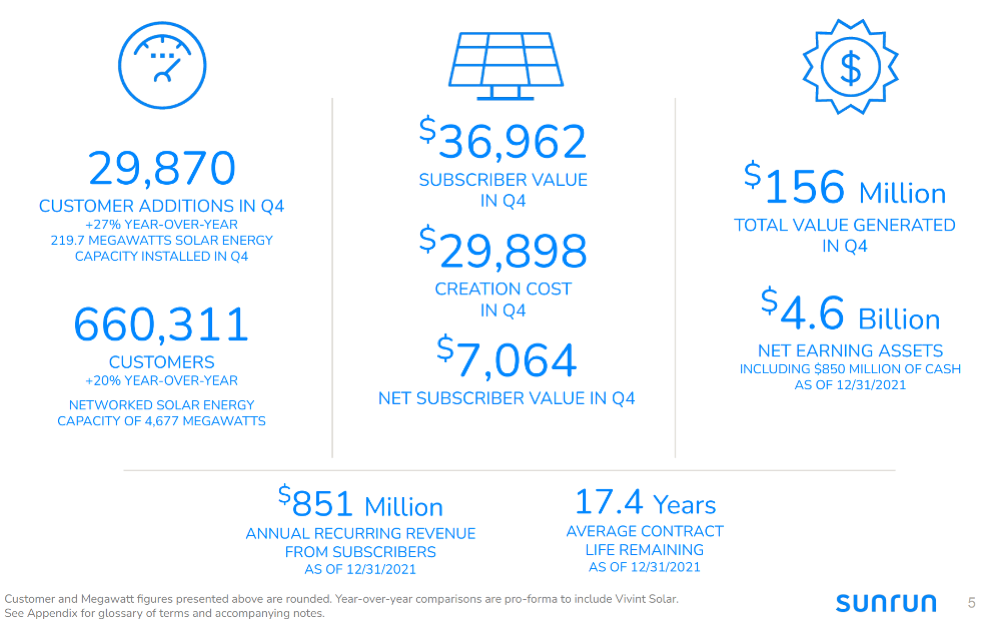

During Q4/2021, Sunrun added 299,870 new customers taking its cumulative to 660,311 as of December 31, 2021. It installed 220 MW during the reporting quarter including 163 MW for subscribers. Total revenue for the quarter was $435 million, compared to $320 million a year back.

As of December 31, 2021, Sunrun’s networked solar energy capacity was 4.677 GW, with that for subscribers being 4.05 GW.

“Several factors, including California net metering, various proposals in Congress to extend and/or increase the investment tax credit, and a volatile interest rate and inflation environment, limit our ability to provide precise guidance on Total Value Generated and cash generation at this time,” it added.

Roth Capital analysts had the following takeaways from the call, “Sunrun delivered a mixed Q4 with a notably weak net subscriber value of $7k. While RUN issued 2022 guidance of >20% growth, the NEM3 uncertainty appears to be weighing on management’s ability to provide a stronger net subscriber value outlook. Price increases could serve as a positive offset for margin expansion.”

In comparison, during Q3/2021 Sunrun deployed 219 MW new solar capacity with revenues increasing 109% annually (see Sunrun’s Q3/2021 Financial Results).