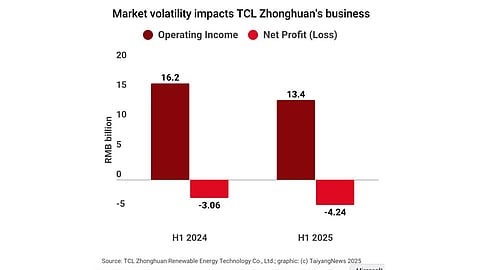

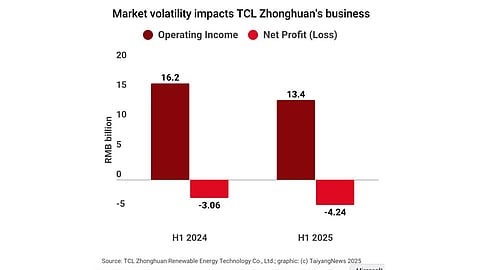

TCL Zhonghuan (TCL TZE) posted a net loss of RMB 4.24 billion in H1 2025, down 38.48% YoY

Its high-efficiency module shipments grew YoY and MoM, narrowing loss per Watt despite market oversupply and price drops

Future strategy includes cost-cutting, advanced solar cell technology, and potential mergers to strengthen market position

TCL Zhonghuan Renewable Energy Technology Co., Ltd. (TCL TZE), the solar wafer and module producer from China, posted a net loss of RMB 4.24 billion ($595 million) in the first half of 2025, down 38.48% year-over-year (YoY). Despite efforts to lower production costs through technological and process improvements, the company said sharp declines in product prices pushed its PV business into a loss.

The Chinese manufacturer admits to facing operating losses in its photovoltaic materials segment despite cost reductions, due to falling product prices. While improvements in solar cell technology and quality boosted high-efficiency module shipments, overall market conditions remained highly competitive and volatile.

Its operating income of RMB 13.4 billion ($1.88 billion) decreased by 17.36%, as a result of industry oversupply and price pressure, coupled with market uncertainties , according to the company’s H1 2025 financial report.

Additionally, TCL TZE shared that the continued rejection of Maxeon Solar Technologies’ modules in the US market has caused product backlogs and a decline in market share for the Singapore-based company, in which it holds a considerable share. TCL TZE acquired the sales and marketing divisions of Maxeon’s non-US business and launched TCL SunPower Global in 2024 to cater to the EMEA region with SunPower-branded solar solutions (see China Solar PV News Snippets: DAS Solar Joins SSI & More).

Nevertheless, TCL TZE says its high-efficiency solar module shipments increased both YoY and month-on-month (MoM), while the loss per Watt narrowed.

At the end of the reporting period, TCL TZE states that its 210 mm silicon wafers completed over 200 GW shipments, and its production capacity reached 200 GW. The company’s cumulative module production capacity reached 24 GW by the end of June 2025.

Looking ahead, TCL TZE said that it plans to cut costs, boost customer loyalty, and advance solar cell technologies to maintain financial stability. The company is also open to exploring mergers and acquisitions to strengthen its position as demand fluctuations persist in the PV market.