Tigo Energy’s Q2 2025 revenues rose 89% YoY, with 76% driven by strong EMEA region demand

The company reported positive adjusted EBITDA and narrowed net loss despite market challenges

ROTH sees an opportunity for Tigo to enter into the US inverter repowering market with its flexible EI inverter that may create a new revenue stream

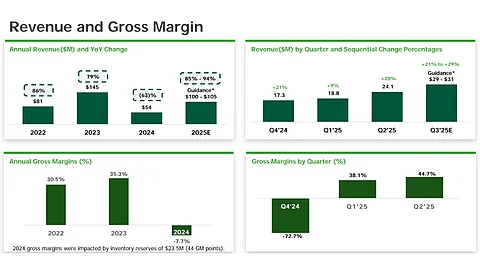

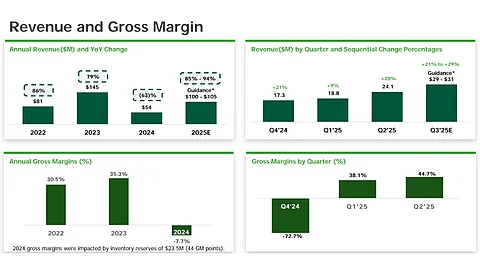

US-based module-level power electronics (MLPE) supplier Tigo Energy has reported its 6th consecutive quarter of revenue growth in Q2 2025, exceeding the higher end of its guidance. Its revenues of $24.1 million increased by 89.4% year-on-year (YoY), and 27.7% on a quarter-on-quarter (QoQ) basis.

Management attributed the increase in revenues to the EMEA region, where it reports strong sequential growth. This region accounted for 76% of its total revenues for the quarter, while the US continued to be stable at 17% of the total.

“We expect that our geographical and manufacturing diversification will continue to minimize our exposure to current tariff headwinds in the industry, while continuing to perform at a competitive level in the U.S. market,” said Tigo Energy Chairman and CEO Zvi Alon.

The company reported a positive adjusted EBITDA of $1.1 million for the quarter, compared to a loss of $6.4 million in Q2 2024 and a loss of $2 million in Q1 2025. The company also managed to narrow its net loss to $4.4 million, compared to a net loss of $11.3 million a year ago. It shipped 646,000 units or 477 MW of MLPE.

Tigo’s flagship MLPE/optimizer products dominated its H1 2025 revenues, with a share of 85%, while 10% came from its full suite of complementary solutions, and 5% from energy intelligence for solar grids.

“Looking ahead, the existing backlog and bookings that are expected to ship in the third quarter currently exceeds our revenue results for the second quarter and we are actively working to restock inventories and ramp capacity in response to increased demand,” added Alon.

Guidance

Tigo forecasts its Q3 2025 revenues to range within $29 million to $31 million, with an adjusted EBITDA of $2 million to $4 million. GAAP operating profit is projected to be at the high end of the adjusted EBITDA guidance range.

For full year 2025, it expects to earn revenues within $100 million and $105 million. Tigo had reported $54 million in revenues for 2024 suffering a 62.8% decline owing to slow inventory movement (see Tigo Energy Q4 2924 Revenues Surge Nearly 87% YoY).

Analysts at ROTH are also upbeat about Tigo’s growth prospects going ahead, especially in the residential segment. ROTH’s Managing Director and Sr. Research Analyst, Philip Shen, points out, “The company is doing it in a scrappy manner and finding opportunities. One example of that is its recently announced plans to serve the US repowering market.”

As residential string solar inverters need to be replaced every 8 to 12 years, this will be a lucrative market for companies like Tigo. The company sells its Energy Intelligence (EI) inverter with a ‘governor’ feature on its output that can avoid the need for re-permitting, making replacements easier. According to ROTH, Tigo may be the only string inverter brand that allows installers to turn an 11.4 kW nameplate inverter into 7 kW or lower. This opens up a new opportunity for the company and a strong source of future growth, added ROTH.