Tigo Energy reported a YoY growth of 86.8% for its Q4 2024 revenues

It shipped 480,000 MLPE units during the quarter with EMEA and Americas accounting for a significant share of revenues

The company reported a gross loss, net loss and adjusted EBITDA loss for FY2024 owing to $23.5 million in inventory charges

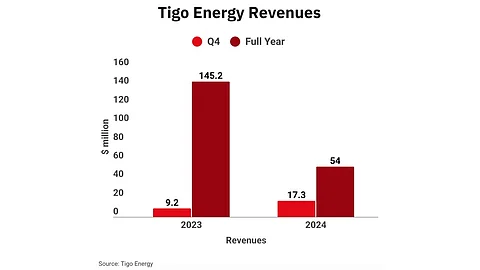

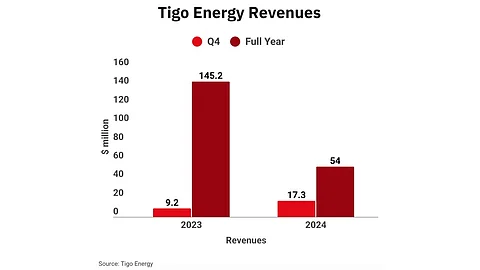

US-based module level power electronics (MLPE) supplier for the solar PV industry Tigo Energy exited 2024 with 4 consecutive quarters of revenue growth. The company saw a 21.3% quarter-on-quarter (QoQ) and 86.8% year-on-year (YoY) improvement in revenues, reporting $17.3 million in Q4 2024.

Most of this growth came from the EMEA and Americas regions as revenues from these regions saw a sequential increase of 29.3% and 57.2%, respectively. The EMEA region represented 65% of the $11.2 million total revenues in Q4 2024, 27% or $4.6 million came from the Americas, while APAC revenues of $1.5 million were 9% of the total revenues with a 44% sequential drop.

An inventory reserve charge of $19.5 million, particularly in its Go ESS storage and solutions business, led to a YoY decline in a gross loss of $12.6 million, compared to a gross profit of $2.9 million in Q4 2023. GAAP net loss widened to $26.8 million, vis-à-vis a net loss of $14.8 million a year back.

Tigo’s CFO Bill Roeschlein attributed the slow inventory movement last year to strong competition in the storage segment as battery prices continue to fall.

During the reporting quarter, Tigo shipped 480,000 MLPE units, taking the total units shipped during 2024 to 1.5 million. The management is also upbeat about its artificial intelligence (AI) software solution Predict, which tracks energy consumption and production.

For full-year 2024, Tigo’s revenues suffered a 62.8% decline at $54 million from $145.2 million in 2023, reporting a gross loss of $4.2 million compared to a gross profit of $51.3 million in the previous year (see Tigo Improved 2023 Revenues Narrowed GAAP Net Loss).

In 2024, the company’s net loss and adjusted EBITDA loss widened from $1 million to $62.7 million and $43.1 million, respectively, from 2023. Tigo stated, “Gross loss, net loss and adjusted EBITDA for the full year 2024 include inventory charges of $23.5 million, primarily for excess and slow-moving inventory within the GO ESS line of energy storage solutions.”

Nevertheless, the management expects to recover from here on as it now expects its FY 2025 revenues to range between $85 million and $100 million. For Q1 2025, it guides for revenues in the $17 million to $19 million range, while expecting an adjusted EBITDA loss of $2.5 million to $4.5 million.

Philip Shen, Managing Director and Senior Research Analyst at ROTH, pointed out that the management has promised a lot of things over the years. He stated, “We would like to see at least one or, better yet, two quarters of strong, clean execution before getting more constructive. We look forward to following management's steady progress in this difficult environment ahead.”