Germany headquartered global chemicals producer Wacker Chemie blames 'persistently difficult market conditions' for its group sales declining 19% annually in Q2/2023 owing to lower selling prices and volumes. Polysilicon business division reported higher volumes, but lower average prices for solar-grade polysilicon in China, pulled down annual sales.

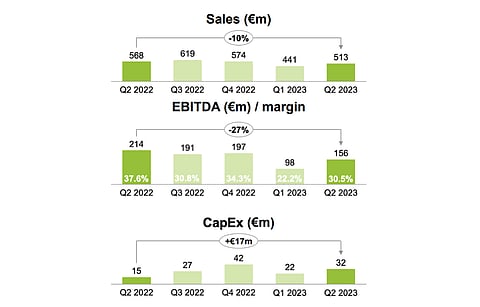

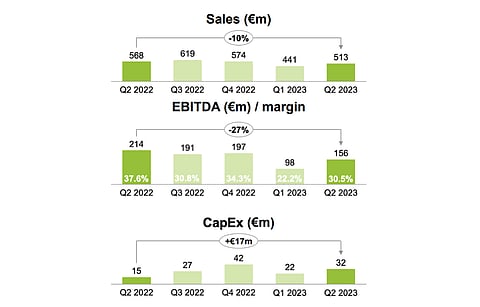

Polysilicon contributed €513 million to Wacker's group sales of €1.75 billion in the reporting quarter, a drop of 10% from €568 million in the previous year (see Wacker Chemie's Q2/2022 Financial Results).

"In addition to the price and volume effects mentioned, the development of earnings growth was held back by persistently high costs for energy and silicon metal," stated the management for its polysilicon business.

Sequentially, Q2 sales grew 16% as Wacker sold significantly higher volumes than in the previous quarter. EBITDA for the reporting quarter went down by 27% YoY to €156 million, but went up 59% vis-à-vis Q1/2023 (see Wacker's Polysilicon Sales Dropped In Q1/2023).

For H1/2023, Wacker's polysilicon sales of €954 million plunged 13% YoY, for which the company attributes lower solar-grade polysilicon volumes and muted customer demand based on volatile polysilicon prices and a maintenance-related scheduled shutdown at the beginning of the year.

Expecting weaker demand in H2 this year, the management has revised its 2023 annual group sales guidance downward to €6.5 billion to €6.8 billion from €7.0 billion to €7.5 billion. To this, polysilicon will contribute between €1.6 billion and €1.7 billion and EBITDA of €300 million to €400 million. The higher end of polysilicon sales and EBITDA guidance has been pulled down from €1.8 billion and €500 million, respectively.

According to TaiyangNews PV Price Index, polysilicon prices were tumbling downhill with new production capacities coming online and supply chain pressures easing; however, in calendar week 30, these are seen to be gradually improving (see TaiyangNews PV Price Index—CW30).