Xinyi Solar’s FY2024 revenues declined with a sharp decline in solar glass prices last year

Its solar glass business reported a 60.5% YoY drop in gross profit, even with sales volumes increasing by 9.6%

The company also recognized an impairment loss of RMB 392.9 million due to underutilization of production facilities

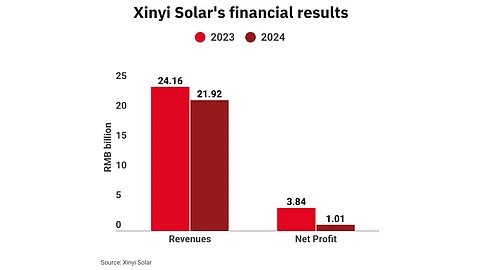

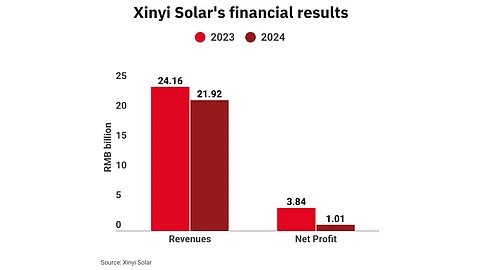

The sharp decline in solar glass prices negatively impacted Chinese supplier Xinyi Solar’s net profit in FY2024 as it reported a 73.8% year-on-year (YoY) decline with RMB 1.01 billion ($139 million). Its revenues for the year RMB 21.9 billion ($3.01 billion) also decreased by 9.3% over the same period.

The Chinese solar glass manufacturer cites reduced profit margins, impairment provisions for the suspended production facilities and inventory write-downs as the factors behind the decline in net profits.

Even though its solar glass sales volumes registered a 9.6% annual growth, its revenue and gross profit were down 11.9% and 60.5%, respectively. The solar glass business division contributed RMB 18.82 billion ($2.59 billion) to group revenue, with 76.7% of it coming from Mainland China.

A decrease in the average selling price (ASP), along with the impairment provisions for certain solar glass production facilities and inventory write-downs, are the major reasons for the decrease in the profit contribution from the Group’s solar glass business for 2024, stated Xinyi.

The company has temporarily stopped operations at some of its solar glass production facilities, to manage inventory levels more effectively amid the demand-supply imbalance in the market, due to which it recognized an impairment loss of RMB 392.9 million ($54.1 million) last year.

Xinyi lowered its operating production capacity for FY2024 from 27,000 tonnes/day as of June 30, 2024, to 23,200 tonnes/day as of December 31, 2024.

It referred to ‘unprecedented challenges’ for the Chinese PV industry in 2024, listing trade barriers, a high-interest rate environment and complex geopolitical conditions, supply and demand imbalances and excessive competition as the reasons for the decline in ASPs.

Trade protection measures have impacted the industry with some countries having either imposed or planned to impose tariffs on imported solar products. However, the group expects little long-term impact on its solar glass business as it will adjust sales locations or use global production facilities to adapt to tariff changes. Xinyi has 6 production facilities in China and Malaysia (see Xinyi Solar’s Multiple Application Solar PV Glass Offerings At SNEC 2024).

Xinyi is also venturing into polysilicon manufacturing with production facilities under construction in Yunnan province. According to the Chinese manufacturer, “Currently, the Group has no plan to expand its polysilicon production capacity. Any future polysilicon investment plans will only be considered after the successful commissioning of the existing production capacity in light of the prevailing market conditions and the Group’s overall business development strategy.”

Its solar farm business division commissioned 300 MW of utility-scale solar PV capacity in H1 2024 and none in H2. Xinyi blamed it on the rising trend of power curtailment in some regions, along with increased requirements for mandatory energy storage and market-based electricity trading leading to greater uncertainty in expected investment returns.