- InfoLink Consulting says Chinese solar module manufacturers exported over 43 GW capacity in 2M/2024

- Europe, India and Brazil together accounted for close to 60% of the total capacity

- As India waits for clarity on ALMM implementation and Brazil faces regulatory changes, Europe will make up for the slowdown in Q2/2024

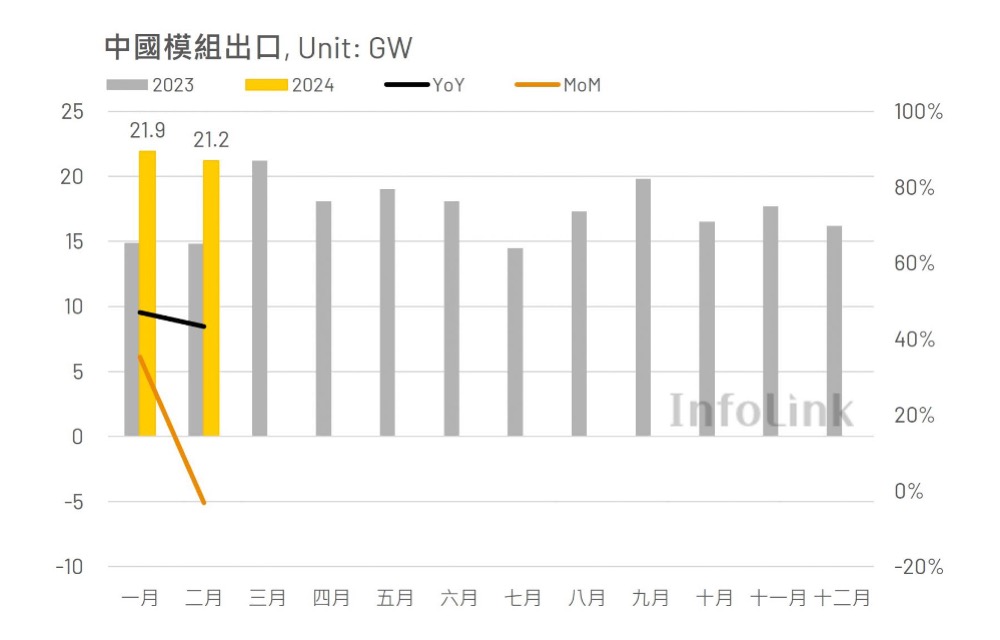

With more than 43 GW of new module exports during January and February 2024, Chinese solar module manufacturers have started the year with a strong year-over-year (YoY) growth of over 45%, with Europe staying put as the largest destination, says InfoLink Consulting.

Compared to 14.85 GW and 14.82 GW in the respective months of January and February 2023, the market intelligence firm counts around 21.9 GW and 21.2 GW of Chinese module shipments in the initial 2 months of 2024, respectively (see Europe Imported 17 GW Chinese Modules In 2M/2023).

Europe, with its 6 GW in January and 8 GW in February months this year, was the largest market for Chinese module exports. The total of 14 GW declined from 17 GW it purchased in 2M/2023. As there are no fears of energy emergency this time around, in Q1/2024, Europe is likely to exceed the 16.1 GW it imported in Q4/2023.

Inventory in the European warehouses has declined by about 50% even though developers took delivery of goods in advance in response to market risks such as the Red Sea crisis leading to increased freight rates and heightened shipping risks.

Modules shipped at the end of 2023 have arrived in Europe in Q1/2024 to replenish European warehouses, dominated by TOPCon like in the last year.

“Downstream module manufacturers have adjusted the CIF/DDP/DAP terms for export to Europe and are preparing to increase prices. However, the actual situation still depends on the outcome of price negotiations with terminals,” observe the analysts.

The Asia Pacific market imported 16.4 GW Chinese modules during the reporting period, representing a 193% YoY increase from 5.6 GW. India and Pakistan were the top 2 buyers in the region. High energy prices in Pakistan are boosting demand for solar energy in the country.

The Indian market battled the uncertainty over the Approved List of Models and Manufacturers (ALMM) during the period. Developers may reduce imports after Q2/2024 as they adopt a wait-and-watch attitude till the government issues clear guidelines for ALMM implementation.

The American market imported close to 3.6 GW Chinese modules in January 2024 and 2.9 GW in February, with the total 6.5 GW representing close to a 44% YoY increase.

Brazil took the largest chunk of this with a combined 5 GW as it builds large-scale projects. Decentralized projects, which have driven Brazil’s solar energy boom so far, are on a downhill now due to regulatory changes. However, analysts expect an improvement in financing opportunities for solar projects with lower interest rates offered by the government.

Imports to Brazil may be impacted in Q2/2024 since a large amount of shipments have already come in during Q1, despite the 9.6% import tariff.

The Middle East market imported around 3 GW and close to 1.9 GW of Chinese modules in 2M/2024. The total of approximately 4.8 GW accounts for an approximately 200% YoY jump over 1.6 GW last year. Saudi Arabia bought 2.6 GW of this total in the 2 months, thanks to the large-scale solar project bidding and Chinese companies working in cooperation agreements with Saudi companies and the government.

Africa purchased 1.3 GW (629 MW in January and 690 MW in February) in 2M/2024, with an increase of 44% YoY. Morocco bought the most at 308 MW, accounting for about 23% of the overall African market.

Altogether, Europe, India and Brazil together accounted for approximately 60% of the global market for Chinese modules in the 2 reporting months. Going forward, InfoLink analysts expect the momentum of purchasing goods to decline in India and Brazil due to regulatory changes.

“However, as the European market enters the traditional peak season in the second quarter, and emerging markets such as Pakistan, the Middle East and Africa are committed to developing solar energy, they are expected to support demand in the second quarter,” they add. “Overall, with the arrival of the peak season in Europe in the second quarter, it will be able to make up for the slowdown in the Indian and Brazilian markets.”

Chinese solar module manufacturers exited 2023 with 208 GW shipped, with 101.5 GW exported to Europe alone (see China Exported 208 GW Solar Modules Globally In 2023).