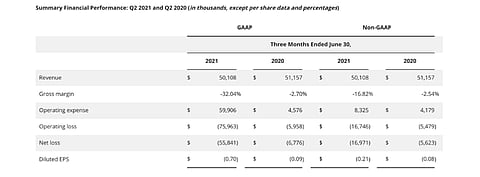

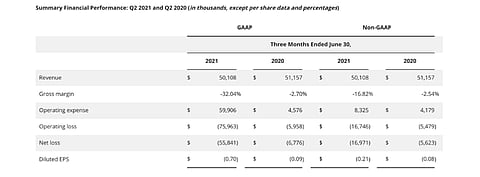

Solar tracker supplier from the US, FTC Solar, Inc. registered a 2% decline in its Q2/2021 revenues that added up to $50.1 million owing to 'slightly lower product volume'. Management said the company had to incur an additional expense of $10 million during the quarter to deal with the current high price global logistics environment in the global supply chain, yet its non-GAAP loss expanded to $-16.97 million, compared to $-5.62 million in Q2/2020.

President and CEO Tony Etnyre said the company is taking 'meaningful actions' to mitigate the impact by developing innovative logistics solutions using alternative shipping methods that provide price certainty to the customers and work out around short-term cost disruptions by working with the customers, something it plans to continue doing in the rest of the year. The aim is to return to profitability in Q4/2021.

"This approach has helped support a continued growth in demand for our products. This demand is reflected in growth of our contracted and awarded orders, which have grown 385% on a year-to-date basis through August 1, with another $203 million added since our last update as of June 1," explained Etnyre. "Excluding the amount included in reported first-half revenue, executed contracts and awarded orders as of August 1 were $478 million, with expected delivery dates in 2021 and 2022."

It is hopeful of strong demand for its products in H2/2021 despite the elevated steel, logistics and other input costs and said customer decision and steel procurement timelines are driving more volume to Q4/2021, as it is not passing on excess costs to customers.

FTC Solar expects its Q3/2021 revenue to range between $56 million and $62 million with adjusted EBITDA of $-19.7 million and $-14.7 million. For Q4/2021, it currently expects a significant increase in revenue on sequential basis, but doesn't define it. Its hopes are based on the company's new logistics methods beginning to take effect in the last quarter of the year, combined with cost roadmap reduction initiatives.

For 2021, the solar tracker maker expects its revenues to exceed $310 million which would reflect an annual growth of more than 65%.

During Q1/2021 FTC Solar said the significant price increase impacts for steel and logistics were manageable (see FTC Solar Q1/2021 Profit Down, Revenues Up).

For more background on trackers, check TaiyangNews' Solar Market Survey on Solar Trackers 2021, which includes 36 tracker products from 19 companies, including FTC (see TaiyangNews Solar Trackers Market Survey 2021)

.png?w=50&fm=png)