Africa added 4.5 GW of solar capacity in 2025, a 54% YoY increase, following 2.93 GW in 2024, says the GSC in a new report

Solar module imports were far higher, reaching 18.2 GW in 2025, highlighting a gap between imports and deployments

A significant share of imported panels is being used in rooftop, off-grid, and other distributed solar systems, which are harder to track but are growing rapidly

Solar growth is becoming more widespread, with more countries crossing or nearing the 100 MW annual installation mark, even as additions remain concentrated in a few leading markets

Solar installations in Africa rose 54% year-over-year (YoY) in 2025, making it a year of the fastest solar growth for the continent, adding 4.5 GW of annual capacity, said the Global Solar Council (GSC).

Utility-scale projects, mainly funded by public and development finance, and privately financed rooftop and distributed systems were the primary reasons responsible for this growth. In 2024, the continent installed over 2.93 GW of solar PV capacity, adjusted from the 2.4 GW previously reported (see Africa Installed 2.4 GW New Solar PV Capacity In 2024).

However, GSC points to the mismatch between solar equipment imports and deployments. Africa imported 18.2 GW of solar modules in 2025, but it is expected to install 14.3 GW of mainly utility-scale capacity across 2026–2027 put together. “This means that one year of imports exceeds two years of utility-scale deployment,” according to the analysts.

The gap suggests that a large share of these imported panels is going into rooftop, off-grid, and other distributed solar systems, not just the utility-scale segment. The increasing rate of storage imports also points to its growing uptake across Africa.

Utility-scale solar accounted for 56% of the reported installations in 2025. Distributed solar, with a 44% share, is 'clearly underestimated as it is harder to track,' says the GSC. Nonetheless, distributed solar is now a core growth engine of Africa.

The GSC’s observation in its flagship annual report, Africa Market Outlook for Solar PV: 2026-2029, echoes the analysis of AFSIA, which recently reported Africa’s total installed solar capacity at about 63.9 GW based on Chinese export data, far above earlier industry estimates (see AFSIA: Africa’s Solar PV Capacity Far Higher Than Estimates).

Growth, nevertheless, is now more widespread than before as the number of countries with 100 MW or higher annual installations doubled from 4 nations in 2024 to 8 last year, while Ghana and Chad inched closer to this threshold, says the GSC. Several mid-sized and emerging markets added substantial solar PV capacity last year, including Morocco (204 MW), Zambia (139 MW), Tunisia (120 MW), Botswana (120 MW), Ghana (92 MW), and Chad (86 MW).

The top 10 countries were responsible for close to 90% of new solar capacity additions on the continent in 2025, led by South Africa’s 1.6 GW, Nigeria’s 803 MW, Egypt’s 500 MW, and Algeria’s 400 MW.

Another trend the report authors highlight is the growth in the uptake of battery storage alongside solar, as evidenced by the rise in solar and battery imports, hinting that these are being paired. As the cost of solar-plus-storage continues to decline, and grid capacity reaches its limits, the GSC expects further growth for these technologies in Africa.

“Solar + storage is the hope of Africa. This is the technology that can bring energy access, sustainable development, green growth and resilience to natural disasters and extreme weather,” Sonia Dunlop, CEO of the Global Solar Council.

The report highlights that most clean energy funding still comes from public and development sources, mainly supporting large utility-scale projects. Although private investment in clean energy has grown from about $17 billion in 2019 to nearly $40 billion in 2024, it is not well-suited for distributed solar, leaving many small and commercial projects facing high financing costs and limited access to capital.

This 'misalignment' between existing finance, planning, and regulatory frameworks and the actual deployment areas poses real risks as it could slow deployment, increase system costs, and limit the economic value of solar, fear the analysts. It needs the right market and policy signals.

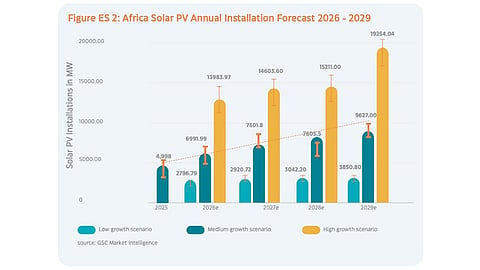

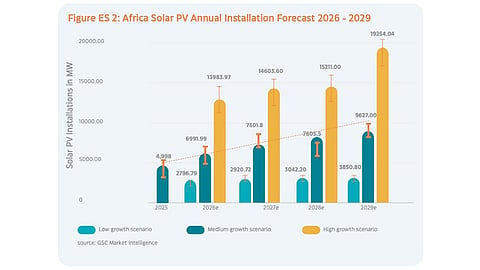

Africa could install over 33 GW of solar capacity by 2029 under the report’s medium scenario, provided that finance, planning, and regulation are aligned with evolving market realities. It also calls for greater adoption of solar and storage to ensure the continent's long-term energy security and economic productivity.

Further, the region needs a stable and predictable policy and regulatory environment to reduce risk, mobilize private capital, and enable long-term project pipelines.

The complete GSC report is available for free download on its website.