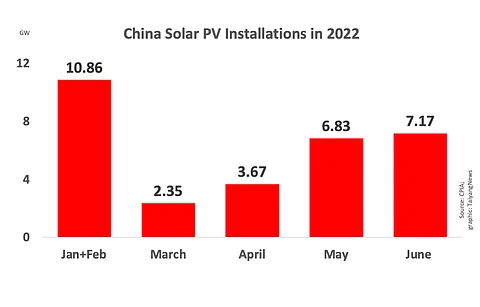

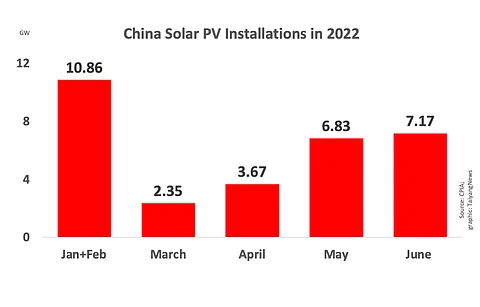

The China Photovoltaic Industry Association (CPIA) says during H1/2022, China installed 30.88 GW of new solar PV capacity, growing 137.4% annually over 14.1 GW reported for the same period last year (see China May Exit 2021 With Up To 65 GW New PV: CPIA).

The association counts 13.21 GW installed in Q1/2022, followed by another 17.67 GW added in Q2/2022 of the total. Cumulative installed PV capacity of the world's largest solar market at the end of June 2022 increased to 340 GW, at the same level as wind power (see China PV News Snippets).

CPIA's Honorary Chairman Wang Bohua said they forecast China to exit 2022 with 75 GW annual installations under a conservative scenario, and 90 GW under its optimistic scenario, which will be in any case much higher than the 54 GW installed in 2021. However, CPIA has not increased its forecast range for 2022, a level it already forecasted in Feb. 2022 (see Up To 90 GW New Solar In China In 2022). For 2023, the association predicts between 80 GW to 95 GW new installations.

Further growth can be expected during the country's 14th Five-Year Plan (FYP) that's supposed to run between 2021 and 2025 as 392.16 GW of total PV capacity is targeted to be installed by 25 provinces, municipalities and autonomous regions during the period. CPIA specified that in the next 4 years, 344.48 GW is to be added.

Bohua also shared an update on the Chinese plan to use its desert regions including Gobi Desert to install 97.05 GW new wind and solar capacity. It said up to now, work on more than 95 GW has been started.

The association acknowledged that the market share of large size silicon wafers has expanded rapidly with some companies having converted all their production lines to produce 182mm and 210mm sized products. However, some firms have tried to replace diamond wire process with tungsten wire which the CPIA believes is expected to further refine the wire diameter and promote thinner wafers, from 165μm to 160μm.

Even in terms of module power thanks to tenders in China, 540W+ has become the mainstream product in the market, something that even EnergyTrend also pointed at in its recent report (see 80% Chinese Producers Get 210mm Capability).

Demand for n-type products is also on the rise as n-type cell expansion projects account for 1/3rd of total expansion capacity. Announced demand for n-type modules has exceeded 4 GW, which is a 4-fold increase compared to entire 2021.

The association also reiterated solar production capacity data for H1/2022 as released by the Ministry of Industry and Information Technology (MIIT) (see China's Solar PV Production Capacity In H1/2022).